金融量化分析【day112】:均值回归策略

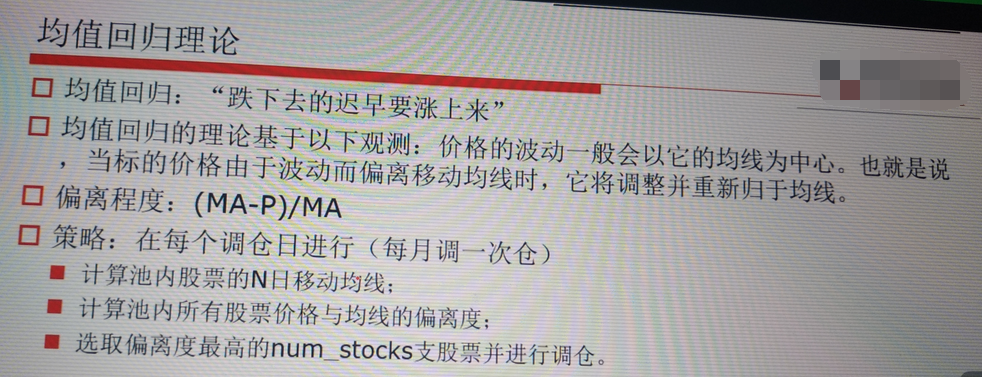

一、均值回归策略

1、什么是回归策略

二、归一标准化

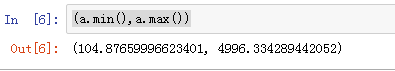

import numpy as np a = np.random.uniform(100,5000,1000) b = np.random.uniform(0.1,3.0,1000) (a.min(),a.max())

输出

预处理

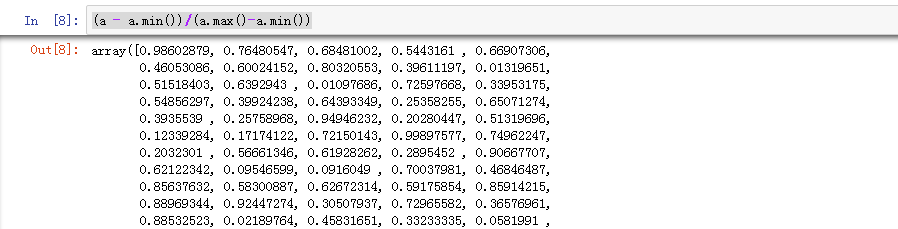

(a - a.min())/(a.max()-a.min())

输出

预处理

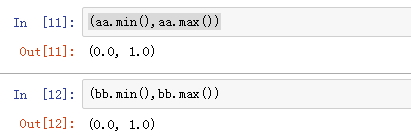

aa = (a - a.min())/(a.max()-a.min()) bb = (b - b.min())/(b.max()-b.min()) (aa.min(),aa.max())

输出

画图

aaa = (a - a.mean())/a.std() import matplotlib.pyplot as plt %matplotlib plt.hist(aaa)

输出

二、均值回归策略代码

# 导入函数库

import jqdata

import math

import numpy as np

import pandas as pd

def initialize(context):

set_benchmark('000002.XSHG')

set_option('use_real_price', True)

set_order_cost(OrderCost(close_tax=0.001, open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock')

g.security = get_index_stocks('000002.XSHG')

g.ma_days = 30

g.stock_num = 10

run_monthly(handle, 1)

def handle(context):

sr = pd.Series(index=g.security)

for stack in sr.index:

ma = attribute_history(stack,g.stock_days)['close'].mean

p = get_current_data()[stack].day_open

ratio = (ma-p)/ma

sr[stock] = ratio

tohold = sr.nlarges(g.stock_num).index.values

for stock in context.portfolio/positions:

if stock not in tohold:

order_target_value(stock, 0)

tobuy = [stock for stock in tohold if stock not in context.portfolio.positions]

if len(tobuy)>0:

cash = context.portfolio.available_cash

cash_every_stock = cash / len(tobuy)

for stock in tobuy:

order_value(stock,cash_every_stock)

作者:罗阿红

出处:http://www.cnblogs.com/luoahong/

本文版权归作者和博客园共有,欢迎转载,但未经作者同意必须保留此段声明,且在文章页面明显位置给出原文连接。

浙公网安备 33010602011771号

浙公网安备 33010602011771号