MM-IV: starter level 1

Part I

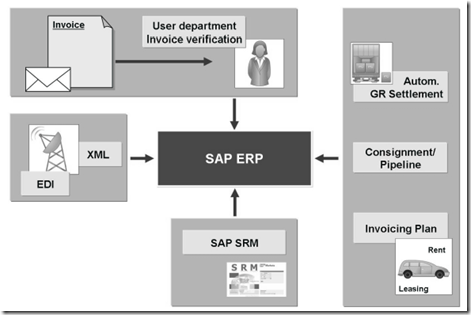

发票过帐的几个方法:

1. The company receives invoices, then the employee enters and posts them.

2. Invoices can be transmitted electronically using the Internet in IDoc (Intermediate Document) format, via EDI (Electronic Data Interchange), or

in XML format. They can then be posted automatically. When using XML, you need to perform some additional mapping of the formats.

3. Invoices can also be created by accounting programs that run regularly in the SAP ERP system (automatic evaluated receipt settlement, invoicing plan and

consignment/pipeline settlement).

4. If you are using SAP SRM, you can create invoices in the SAP SRM system. You can then transfer them to the SAP ERP system. (BBPIV01?)

发票过帐带来的结果:

The system posts the amounts for the individual items to the appropriate accounts.

The system creates an MM invoice document and an FI document.

The system updates the purchase order history.

The system updates the material master, if necessary.

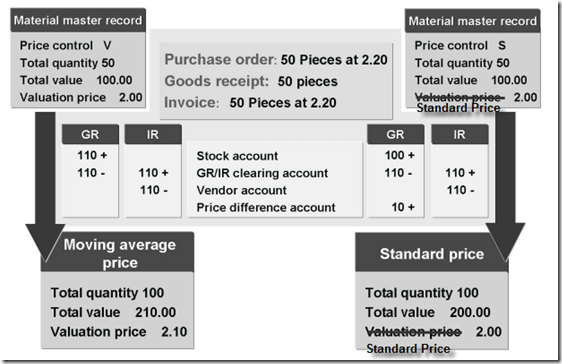

物料平均价/标准价 (MAP/Standard Price)

MAP: the valuation price is adjusted to the delivered price

收货时,过帐给stock account的数量,即为采购价*发货数量.

如果发票价不同于订单价,价差过帐到stock account

S:价差过帐到price difference account

举例:

收货时,stock account是借方(+)

MAP: stock account是由订单价*收货数量 (2.2*50=110)

S: stock account是由标准价*收货数量 (2.0*50=100) 这样的算法,就产生了差额,为了在损益表中体现,该差额过帐到price differences account (110-100=10)

有借必有贷,贷方(-)就冲销到GR/IR clearing account. 冲销金额=订单价*收货数量.(2.20*50=110))

在发票过帐时,GR/IR clearing account被清除, vendor account成为贷方.

输入:

发票过帐时,一般需要输入 Document date, purchase order number, Invoice amount, tax amount, terms of payment (if necessary)

从采购凭证自动带来的数据有Vendor, terms of payment (if defined there), currency, Invoice items;

quantity and amount are derived for each item from the purchase order history

从供应商主数据和配置带过来的数据有The bank information, Default value for the tax rate

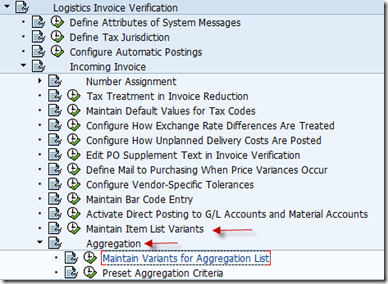

Allocation:

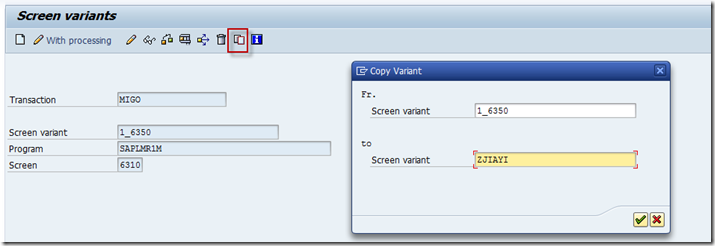

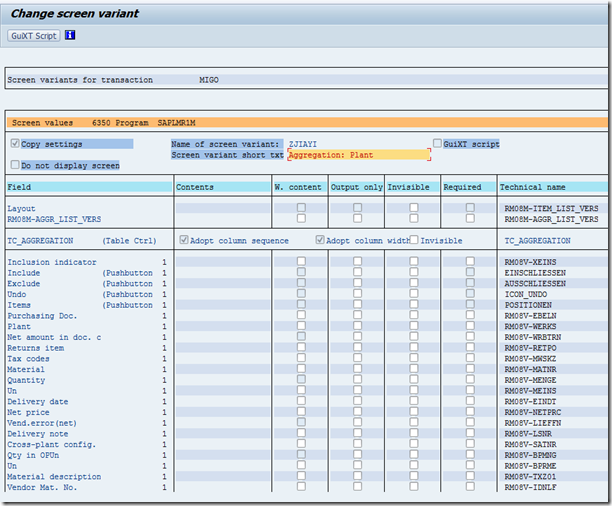

Layout: {Variant(screen 6310)/Aggregation(screen 6350}

拷贝一个最实惠拉

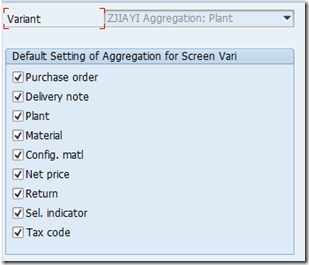

Present aggregation criteria

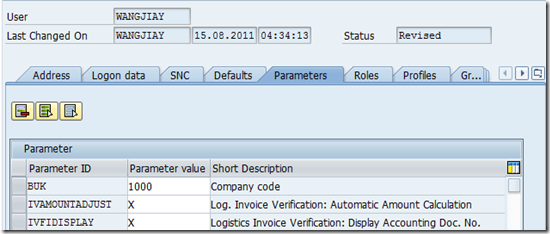

User Parameter in IV: (as of 4.6C)

The parameter IVFIDISPLAY ensures that the document number of the FI accounting document is displayed in the status bar as well as the MM invoice document number.

The parameter IVAMOUNTADJUST makes it easier to correct the quantity and amount in an invoice item.

Transaction related to IV:

Enter Invoice (MIRO)

Park Invoice (MIR7)

Cancel Invoice (MR8M)

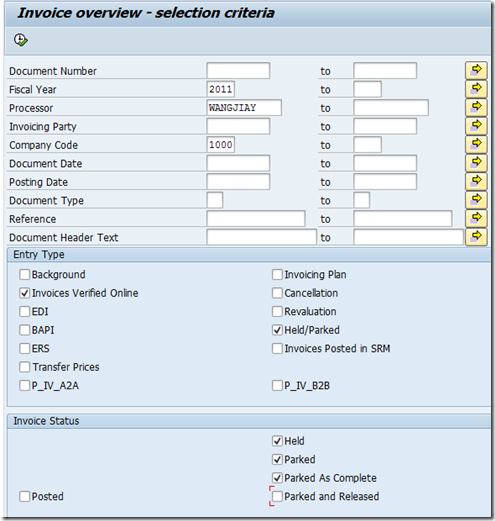

Invoice Overview (MIR6)

Evaluated Receipt Settlement (MRRL)

Revaluation (MRNB)

Invoicing Plan (MIRS)

Invoice Verification in the Background (program RMBABG00)

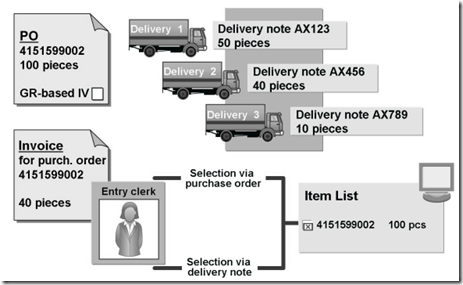

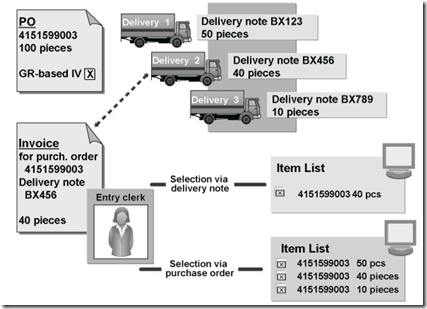

PO-Based IV & GR-Based IV:

PO-Based IV在做IV allocation时, 只能调出整单的数量

GR-Based IV在做IV allocation时,可以调出各次收货的数量

PO history同样验证了该点. 同时可发现,PO-Based, GR-Based对于收货来说,都是同样的表现--收一单现一行.

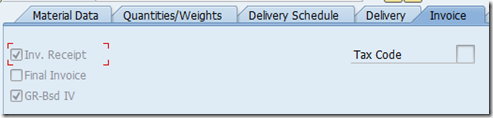

GR-Based IV的前提是: 在Invoice标签里勾选,该标记可通过供应商主数据或source of supply带过来. 勾选该标记后,需收货才可发票过帐.

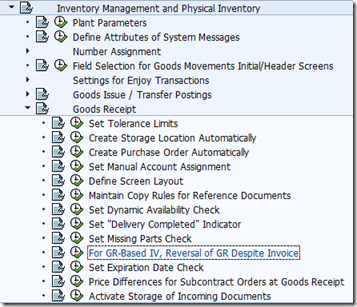

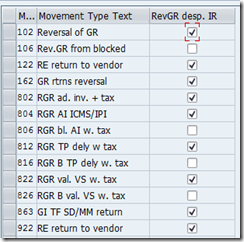

对于GR-Based IV, 可以选择在做了IV之后,是否允许做102取消收货,或退货等操作. [OMBZ]

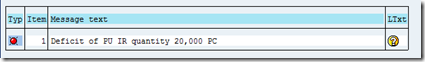

如果不允许(即不勾选)则在做反向操作时出现Message no. M7021

Note 184632!!! READ!!

Part II

Document Parking

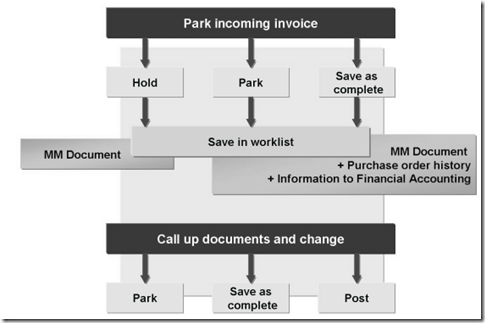

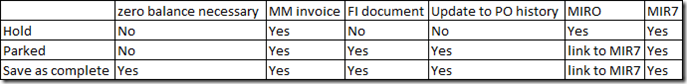

Hold: (MIRO/MIR7) When you hold a document, the system only performs minimal checks (such as the existence of the company code, vendor, and company code). A MM invoice document is created. No information is transferred yet to Financial Accounting, and no updates are made to the purchase order history.

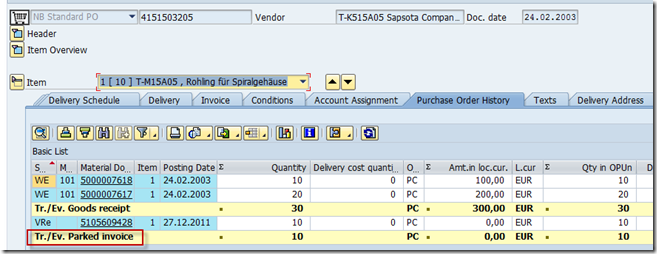

Park: (MIR7) The balance does not have to be zero. An MM invoice document is created, and the purchase order history is updated. Information is also transmitted to Financial Accounting.

Save as complete: (MIR7) The balance must be zero or fall within the tolerance for small differences or the vendor-specific tolerances. The same checks are carried out as for parking documents. The purchase order commitments are also canceled out.

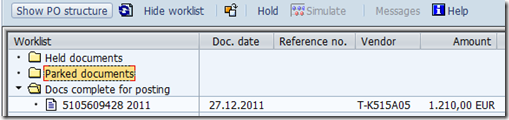

Worklist: continue processing held documents, parked documents and documents that are saved as complete.

MIR6 allows you to access documents that were created by other users.

Tables:

RBKP: MM invoice document

BKPF: Accounting document

Summary:

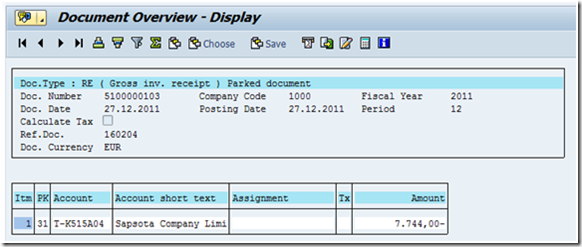

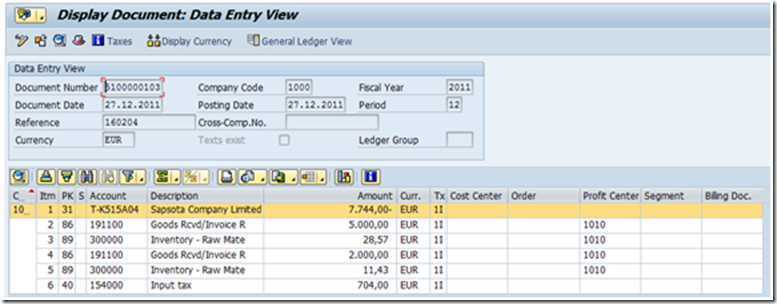

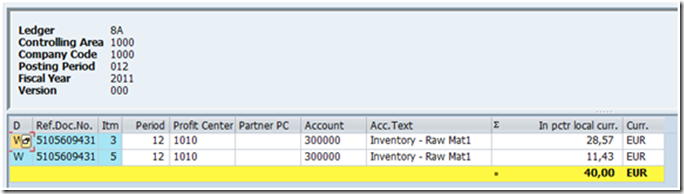

for Parked and Save as completed, the FI document contains header information and only one posting line for the vendor account.

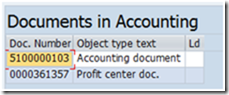

After posting, it has the below documents:

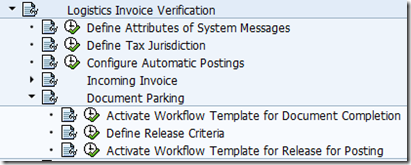

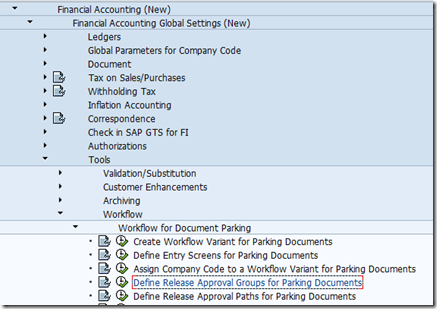

Workflow:

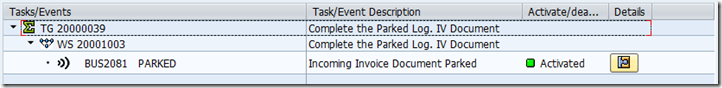

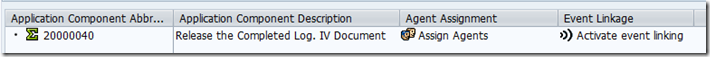

1. WS20001003: Complete parked documents

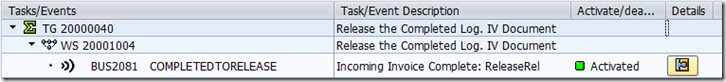

2. WS20001004: Release documents that are saved as complete.

配置步骤

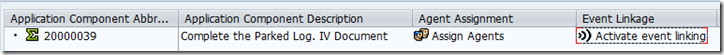

- Activate Event Linking

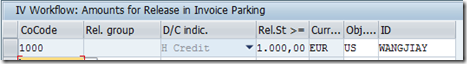

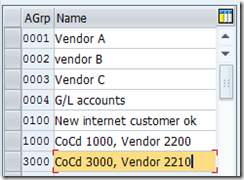

- Release criteria

同样的情况下,有rel. group的级别更高,可以在这里配置

另可在这里做增强: customer exit EXIT_SAPLMRMC_002 of the enhancement LMR1M005

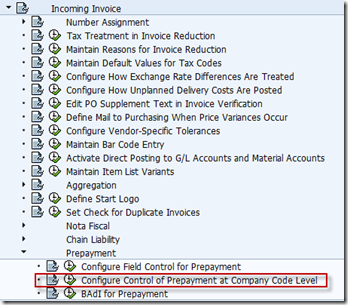

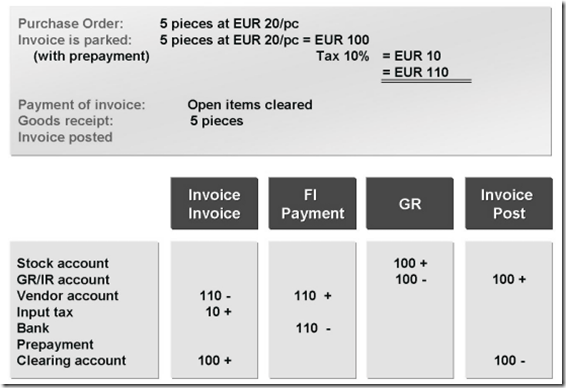

Prepayment: (As of ECC 6.0)

前提

1. Define the document type for the FI document that is generated when an invoice is posted with a prepayment document.

2. Prepayment must be permitted in the vendor master record with the Prepayment indicator.

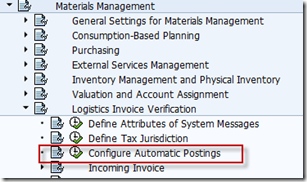

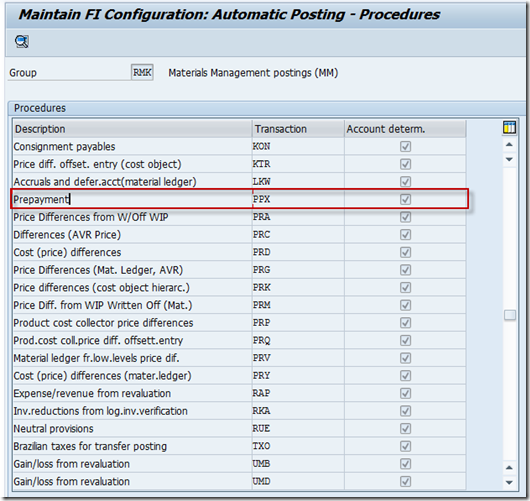

3. There must be a general ledger account defined for transaction PPX (prepayment) in Customizing for the account determination.

操作: To create an invoice with prepayment, you must enter the invoice with transaction Park Incoming Invoice (MIR7) or transaction Enter Invoice for Invoice Verification in Background (MIRA). The prepayment can also be used during an invoice entry with an Electronic Data Interchange (EDI) or BAPI.

If the prepayment status of an invoice is (A) Relevant, invoice not yet savedwhen it is parked or held, a prepayment is generated in financial accounting as

an FI invoice. (This FI document is generated with the document type that is specified in the document header on the Detail tab page.) The system posts the relevant data for the payment in financial accounting against a clearing account for the prepayment and generates an open vendor item. The payment of the vendor invoice can then occur independently of the goods receipt entry and invoice verification. An invoice verification does not occur at item level when the prepayment occurs. The system does not determine variances between the invoice and the purchase order or goods receipt. Neither does it set an automatic payment block for the prepayment in accordance with the tolerance limits that can be set in Customizing.

When the held or parked document is posted, the clearing account of the prepayment is balanced instead of the vendor posting and tax posting.

Prepayment is not possible in the below:

For credit memos and subsequent credits

For one-time vendors

In conjunction with import sales/purchases tax or acquisition tax

For invoices whose cash discount base amount is different from the tax base amount

For invoices with more than one tax rate and which use the Calculate Tax function.

Invoices with the American tax jurisdiction code.

For plants with an active material ledger

Badi WRF_PREPAY_INVOICE:

Method SET_POSTING_DATE lets you select a posting date other than the system date for the prepayment document.

Method PREPAYMENT_RELEVANCE_CHANGE lets you implement extended logic to control the prepayment relevance (request or reject). To do so, the Business Add-In provides the invoice document header (RBKP) at runtime. Until a prepayment document is posted, you can use method PREPAYMENT_RELEVANCE_CHANGE to override the Prepayment Relevancefield from the header of the current logistics invoice, and thus prevent (or trigger) prepayment.

Note: 937129 Restrictions that apply to prepayment

958136 Advance payment: Credit memo instead of FI reversal document

Part III

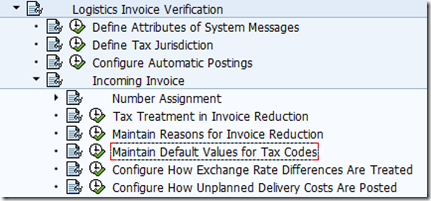

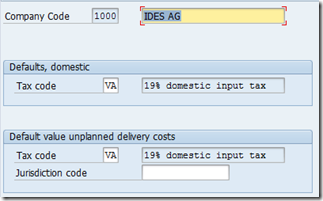

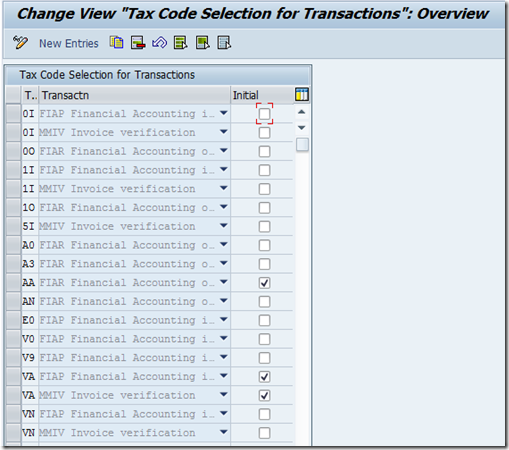

Tax Code:

Define which tax code is a default for each company code when you enter invoices on the Basic Data tab page.

Define which tax code is a default for unplanned delivery costs on the Detail tab page. The setting for unplanned delivery costs is relevant only if these costs

are posted automatically to a separate G/L account line.

Define which values are available in the input help (F4 help) for the Tax Code field in the basic data and the items. (If you enter the tax data on the Tax tab page, the input help proposes all tax codes.)

[OBZT] country based

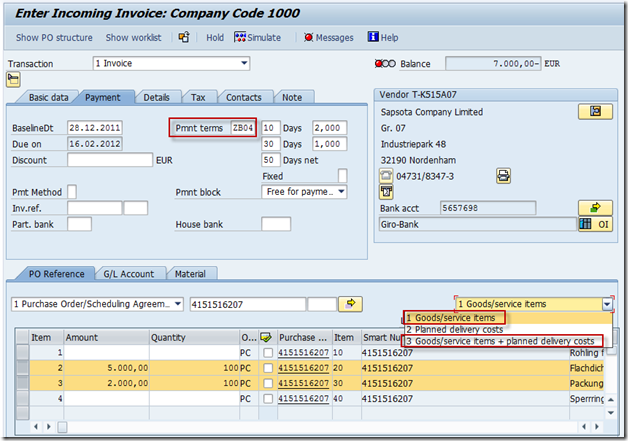

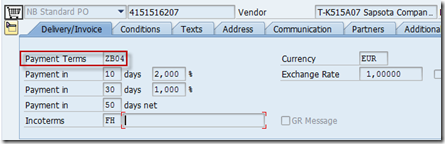

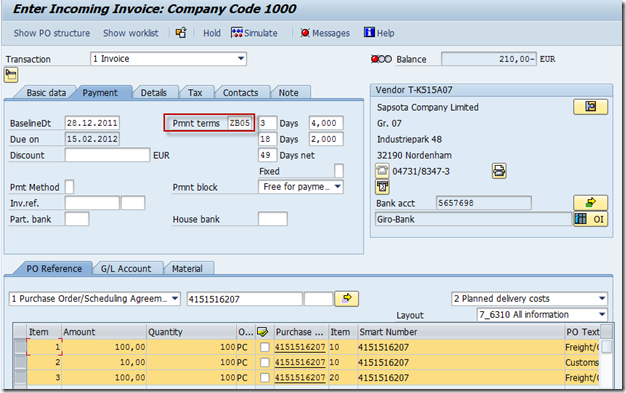

Terms of Payment

在做invoice/credit memo/subsequent debit/subsequent credit时,如果有PO作为参考:

- 当goods/service items或goods/service items+planned delivery cost时, terms of payment从PO的header取得

- 当planned delivery cost时, From the company code data of the vendor that is planned for the delivery costs. (似乎不对)

在做invoice/subsequent debit时,如果没有PO作为参考:

From the company code data of the invoicing party (vendor) that is to be entered manually.

在做credit memo/subsequent credit时,如果没有PO作为参考:

no proposal

配置:

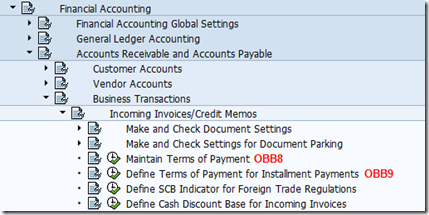

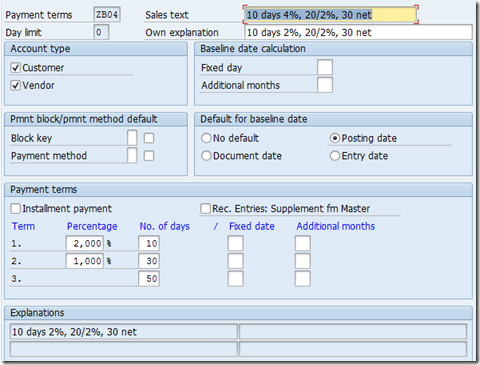

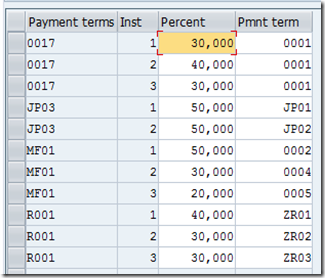

[OBB8] [OBB9]

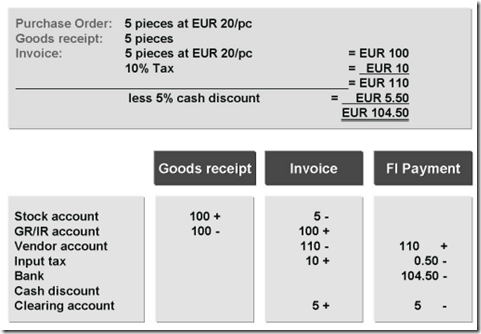

Cash Discount (Gross posting)

If you post the gross amount of an invoice, the system ignores the cash discount amount when you enter the invoice; it posts the cash discount

amount to a Cash Discount account at the time of payment. Therefore, the cash discount amount is not credited to the stock or cost account.

- The cash discount amount for the net invoice value is posted as a non-operating result.

- When the invoice is posted, the system first posts a tax amount that is too high, since the tax does not take account of the cash discount. When the payment is made, the input tax posting is automatically corrected, and the tax amount for the cash discount is credited to the input tax account.

Cash Discount (Net posting)

If you post the net amount of an invoice, the system posts the cash discount amount from a cash discount clearing account to the stock or cost account.

This means the system only posts the amount reduced by the cash discount amount to the stock account/costs account. The cash discount clearing

account is cleared at the time of payment.

The cash discount amount is already taken into account when the invoice is net posted.

The cash discount amount is posted to a cash discount clearing account; this is cleared at the time of payment.

The offsetting posting to the cash discount clearing account is dependent on the price control of the material:

If the material is managed with a standard price, the cash discount is credited to the price difference account.

If the material is managed with a moving average price, the cash discount is credited to the stock account. If there is no stock coverage, then only a

part, for which the stock coverage exists, is posted to the stock account. It posts the remainder to the price difference account.

When the payment is made, the input tax posted in the invoice is corrected.

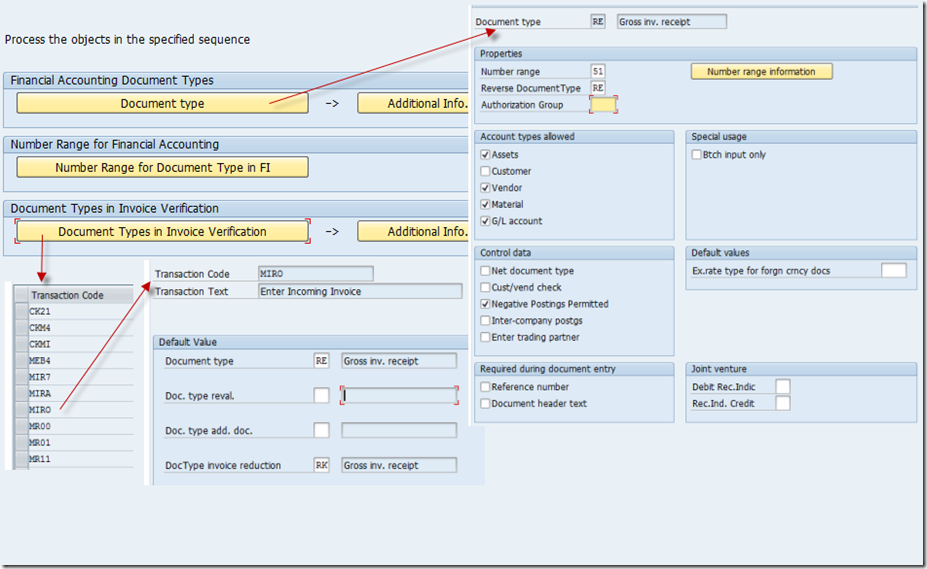

Document Type for Accounting Document

[OMR4]

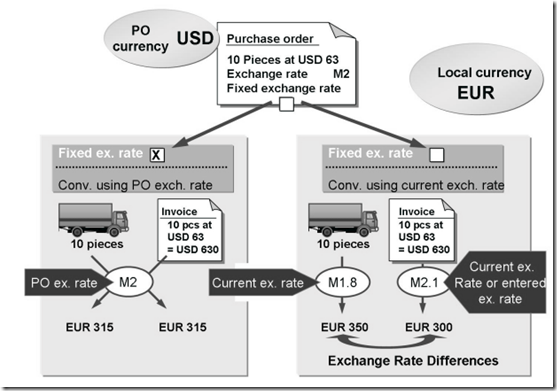

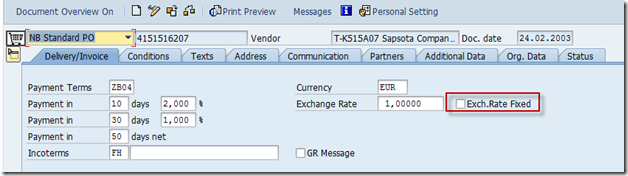

Foreign Currency

If this rate is fixed, the system uses the exchange rate from the purchase order to convert the foreign currency to the local currency at goods receipt

and at invoice receipt.

(勾选,则在GR,IV时,选择采购订单里的汇率)

If the exchange rate is not fixed, the system uses the current exchange rate to convert the foreign currency to the local currency at goods receipt. In

Invoice Verification, the system also suggests the current exchange rate as the exchange factor, but you can change it.

(未勾选,GR时采购后台配置中的汇率,IV时也是,但可以更改.)

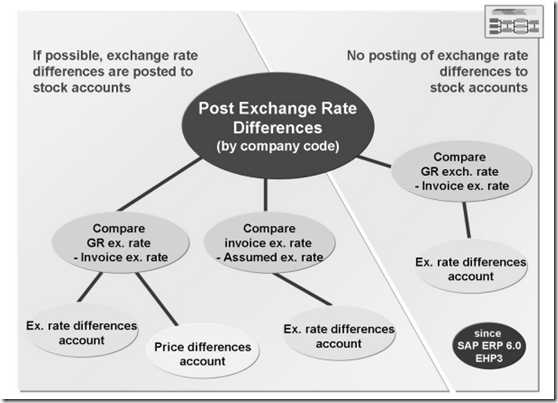

所以在未勾选时,可能会有汇率差:

- 当采购订单有科目分配时,汇率差(exchange rate difference)的金额借记/贷记到clearing account

- 当使用移动平均价+stock coverage时,汇率差的金额借记/贷记到stock account

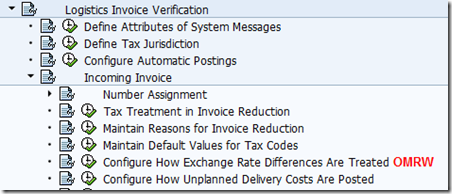

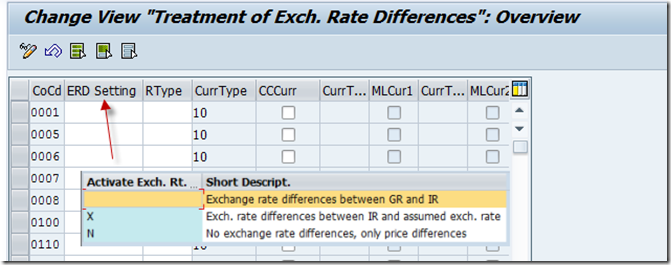

- 当仅使用移动平均价,或标准价, 可以在后台配置[OMRW]选择汇率差的金额借记/贷记到一个特殊的汇率差科目,或一个普通的价差科目price difference account

SAP ERP 6.0 Enhancement Package 3 and later feature another alternative in Customizing: You can use the Treatment of Exchange Rate Diffs. in Company

Code Currency indicator to ensure that the amount of the exchange rate difference is always posted in the full amount to an exchange rate difference account,

regardless of the material's price control, and when there are purchase order items with account assignment. The settings of the Treatment of Exch. Rate Differences indicator are no longer relevant in this situation. The stocks or consumption are then valuated for the exchange rate of the goods receipt and not the exchange rate of the invoice. The exchange rate of the purchase order does not come into play when goods receipts are posted and the conversion of the purchase order values into the local currency always occurs for the posting date of the goods receipt.

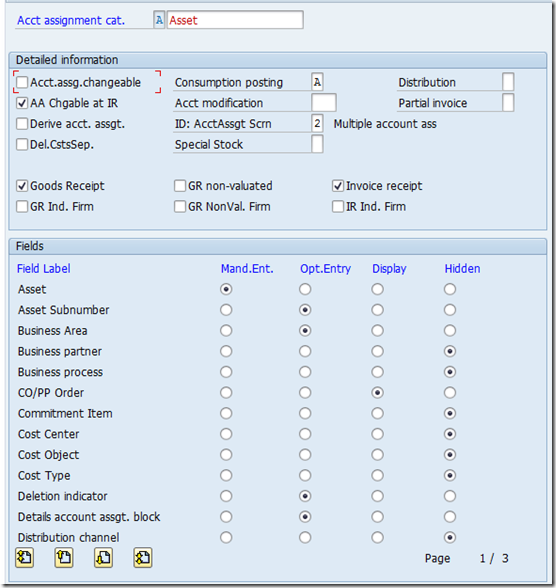

Invoices for POs with Account Assignment

科目分配在以下情况使用: 购买的货物不计入库存管理而是直接消耗; 购买外部服务

科目分配类别(account assignment category)决定了是否需要收货,是否需要做发票过帐.

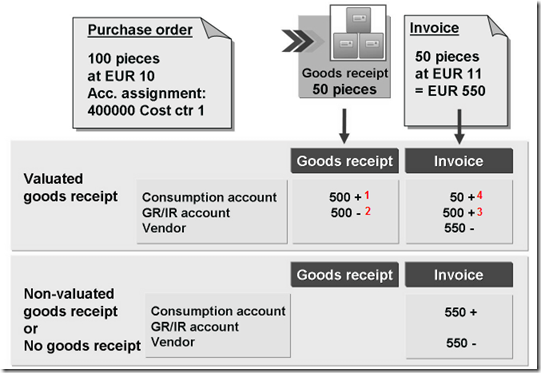

If a valuated goods receipt is defined for a purchase order with account assignment:

1. The system debits the consumption account at goods receipt.

2. The offsetting entry is made to the GR/IR clearing account and

3. Cleared by the invoice.

4. The system debits or credits price variances to the consumption account.

If no goods receipt or only a non-valuated goods receipt is defined for a purchase order with account assignment

1. the posting to the consumption account occurs directly when the invoice is posted.

Multiple Account Assignment

As of SAP ERP 6.0 Enhancement Package 4, a valuated goods receipt can also be posted for purchase order items with multiple account assignment.

激活 LOG_MM_MAA_1

Valuated goods receipt is still not possible for multiple account assignment of subcontracting items.

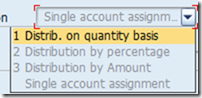

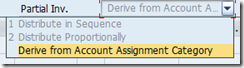

在多重科目分配时,可以按照数量,百分比或金额来分配

另外还有个partial inv.的标记,定义在做发票过帐时,按次序分,或按比例分

You can use the BAdI MB_ACCOUNTING_DISTRIBUTE to redefine the distribution to individual account assignments when you enter a valuated goods receipt for a purchase order item with multiple account assignment.

浙公网安备 33010602011771号

浙公网安备 33010602011771号