Aeron chairs, retailed for $1,100 each...

An economic bubble or asset bubble (sometimes also referred to as a speculative bubble, a market bubble, a price bubble, a financial bubble, a speculative mania, or a balloon) is a situation in which asset prices appear to be based on implausible or inconsistent views about the future. It could also be described as trade in an asset at a price or price range that strongly exceeds the asset's intrinsic value.

While some economists deny that bubbles occur, the causes of bubbles remain disputed by those who are convinced that asset prices often deviate strongly from intrinsic values.

Many explanations have been suggested, and research has recently shown that bubbles may appear even without uncertainty, speculation, or bounded rationality, in which case they can be called non-speculative bubbles or sunspot equilibria. In such cases, the bubbles may be argued to be rational, where investors at every point are fully compensated for the possibility that the bubble might collapse by higher returns. These approaches require that the timing of the bubble collapse can only be forecast probabilistically and the bubble process is often modelled using a Markov switching model. Similar explanations suggest that bubbles might ultimately be caused by processes of price coordination.

More recent theories of asset bubble formation suggest that these events are sociologically driven. For instance, explanations have focused on emerging social norms and the role that culturally-situated stories or narratives play in these events.

Because it is often difficult to observe intrinsic values in real-life markets, bubbles are often conclusively identified only in retrospect, once a sudden drop in prices has occurred. Such a drop is known as a crash or a bubble burst. In an economic bubble, prices can fluctuate erratically and become impossible to predict from supply and demand alone.

Asset bubbles are now widely regarded as a recurrent feature of modern economic history dating back as far as the 1600s. The Dutch Golden Age's Tulipmania (in the mid-1630s) is often considered the first recorded economic bubble in history.

Both the boom and the bust phases of the bubble are examples of a positive feedback mechanism (in contrast to the negative feedback mechanism that determines the equilibrium price under normal market circumstances).

The term "bubble", in reference to financial crisis, originated in the 1711–1720 British South Sea Bubble, and originally referred to the companies themselves, and their inflated stock, rather than to the crisis itself. This was one of the earliest modern financial crises; other episodes were referred to as "manias", as in the Dutch tulip mania. The metaphor indicated that the prices of the stock were inflated and fragile – expanded based on nothing but air, and vulnerable to a sudden burst, as in fact occurred.

The South Sea Company (officially The Governor and Company of the merchants of Great Britain, trading to the South Seas and other parts of America, and for the encouragement of the Fishery) was a British joint-stock company founded in January 1711, created as a public-private partnership to consolidate and reduce the cost of the national debt.

Joseph Spence wrote that Lord Radnor reported to him "When Sir Isaac Newton was asked about the continuance of the rising of South Sea stock... He answered 'that he could not calculate the madness of people'." He is also quoted as stating, "I can calculate the movement of the stars, but not the madness of men". Newton himself owned nearly £22,000 in South Sea stock in 1722, but it is not known how much he lost, if anything. There are, however, numerous sources stating he lost up to £20,000 which would equate to over $3,000,000 adjusted for U.S. currency in 2003.

There are different types of bubbles, with economists primarily interested in two major types of bubbles:

An equity bubble is characterised by tangible investments and the unsustainable desire to satisfy a legitimate market in high demand. These kind of bubbles are characterised by easy liquidity, tangible and real assets, and an actual innovation that boosts confidence. Two instances of an equity bubble are the Tulip Mania and the dot-com bubble.

A debt bubble is characterised by intangible or credit based investments with little ability to satisfy growing demand in a non-existent market. These bubbles are not backed by real assets and are characterized by frivolous lending in the hopes of returning a profit or security. These bubbles usually end in debt deflation causing bank runs or a currency crisis when the government can no longer maintain the fiat currency. Examples include the Roaring Twenties stock market bubble (which caused the Great Depression) and the United States housing bubble (which caused the Great Recession).

The dot-com bubble (also known as the dot-com boom, the tech bubble, and the Internet bubble) was a stock market bubble caused by excessive speculation of Internet-related companies in the late 1990s, a period of massive growth in the use and adoption of the Internet.

The NASDAQ Composite index spiked in the late 1990s and then fell sharply as a result of the dot-com bubble; Quarterly U.S. venture capital investments, 1995–2017

The 1993 release of Mosaic and subsequent web browsers gave computer users access to the World Wide Web, greatly popularizing use of the Internet. Internet use increased as a result of the reduction of the "digital divide" and advances in connectivity, uses of the Internet, and computer education. Between 1990 and 1997, the percentage of households in the United States owning computers increased from 15% to 35% as computer ownership progressed from a luxury to a necessity. This marked the shift to the Information Age, an economy based on information technology, and many new companies were founded.

At the same time, a decline in interest rates increased the availability of capital. The Taxpayer Relief Act of 1997, which lowered the top marginal capital gains tax in the United States, also made people more willing to make more speculative investments. Alan Greenspan, then-Chair of the Federal Reserve, allegedly fueled investments in the stock market by putting a positive spin on stock valuations. The Telecommunications Act of 1996 was expected to result in many new technologies from which many people wanted to profit.

As a result of these factors, many investors were eager to invest, at any valuation, in any dot-com company, especially if it had one of the Internet-related prefixes or a ".com" suffix in its name. Venture capital was easy to raise. Investment banks, which profited significantly from initial public offerings (IPO), fueled speculation and encouraged investment in technology. A combination of rapidly increasing stock prices in the quaternary sector of the economy and confidence that the companies would turn future profits created an environment in which many investors were willing to overlook traditional metrics, such as the price–earnings ratio, and base confidence on technological advancements, leading to a stock market bubble. Between 1995 and 2000, the Nasdaq Composite stock market index rose 400%. It reached a price–earnings ratio of 200, dwarfing the peak price–earnings ratio of 80 for the Japanese Nikkei 225 during the Japanese asset price bubble of 1991. In 1999, shares of Qualcomm rose in value by 2,619%, 12 other large-cap stocks each rose over 1,000% in value, and seven additional large-cap stocks each rose over 900% in value. Even though the Nasdaq Composite rose 85.6% and the S&P 500 Index rose 19.5% in 1999, more stocks fell in value than rose in value as investors sold stocks in slower growing companies to invest in Internet stocks.

An unprecedented amount of personal investing occurred during the boom and stories of people quitting their jobs to trade on the financial market were common. The news media took advantage of the public's desire to invest in the stock market; an article in The Wall Street Journal suggested that investors "re-think" the "quaint idea" of profits, and CNBC reported on the stock market with the same level of suspense as many networks provided to the broadcasting of sports events.

At the height of the boom, it was possible for a promising dot-com company to become a public company via an IPO and raise a substantial amount of money even if it had never made a profit—or, in some cases, realized any material revenue. People who received employee stock options became instant paper millionaires when their companies executed IPOs; however, most employees were barred from selling shares immediately due to lock-up periods. The most successful entrepreneurs, such as Mark Cuban, sold their shares or entered into hedges to protect their gains.

On November 9, 2000, Pets.com, a much-hyped company that had backing from Amazon.com, went out of business only nine months after completing its IPO. By that time, most Internet stocks had declined in value by 75% from their highs, wiping out $1.755 trillion in value.

By the end of the stock market downturn of 2002, stocks had lost $5 trillion in market capitalization since the peak. At its trough on October 9, 2002, the NASDAQ-100 had dropped to 1,114, down 78% from its peak.

Layoffs of programmers resulted in a general glut in the job market. University enrollment for computer-related degrees dropped noticeably. Anecdotes of unemployed programmers going back to school to become accountants or lawyers were common.

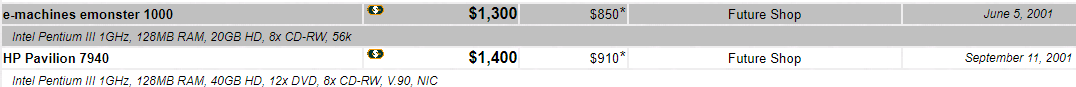

Aeron chairs, which retailed for $1,100 each and were the symbol of the opulent office furniture of dot-com companies, were liquidated en masse. $1 in 2000 is equivalent in purchasing power to about $1.63 today (2022-2-23). [link] 八千块买双鞋,了不起啊?

Pentium III 1GHz, 180 nm, 256 KB L2 Cache, TDP 29 W, TCASE 75°C. 二十年来,Intel好像一直在保持TCASE 75°C的前提下使劲堆晶体管。The point is: 75°C是安全的。有本讲美国某销售的鸡汤书(名字忘了)说(大意): 客户说我们的电动机很烂,摸起来烫手。话术:不要直接说客户你错了。而是:哦,电动机摸起来烫手是挺烦的啊…… 电机协会对最高温度是有规定的,我不是专业人士,您知道吗?客户:75°C。哦,75°C好像是会烫手哦。

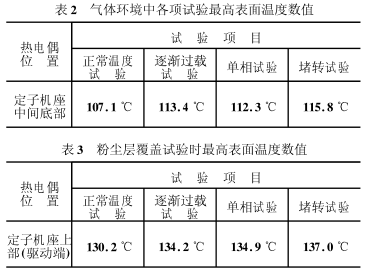

美国UL674标准对防爆电机温度试验的有关要求 - 豆丁网 (docin.com)

六级/考研单词: bubble, speculate, balloon, situate, plausible, intrinsic, convince, seldom, deviate, lately, uncertain, rational, invest, compensate, forecast, coordinate, sociology, norm, retrospect, gradual, crash, burst, fluctuate, bust, inflate, episode, metaphor, fragile, vulnerable, merchant, consolidate, nationwide, equate, equity, tangible, desire, legitimate, innovate, boost, confide, roar, depress, unite, recession, excess, composite, venture, web, compute, digit, educate, luxury, necessity, spin, telecommunications, eager, rapid, overlook, dwarf, unprecedented, quit, medium, journal, suspend, podcast, million, execute, entrepreneur, hedge, pet, wipe, trillion, layoff, anecdote, wholesale, furnish

浙公网安备 33010602011771号

浙公网安备 33010602011771号