Financial Reporting and Analysis 8

R22:Long-lived Assets

1、Acquisition of Long-lived Assets:长期资产的购置

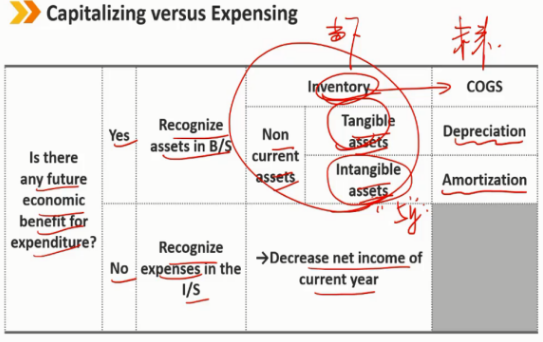

1.1 Capitalizing versus Expensing:资本化与费用化

判断一项花销是进行资本化还是费用化,就看这项花销购买的东西能否在未来可以源源不断带来收益,如果可以,则进行资本化,如果不能,则进行费用化

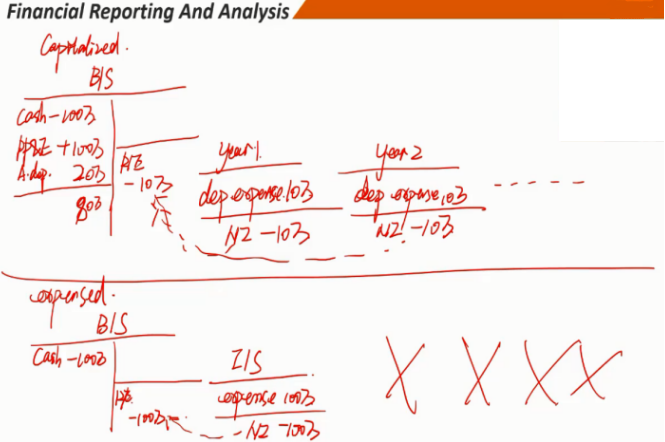

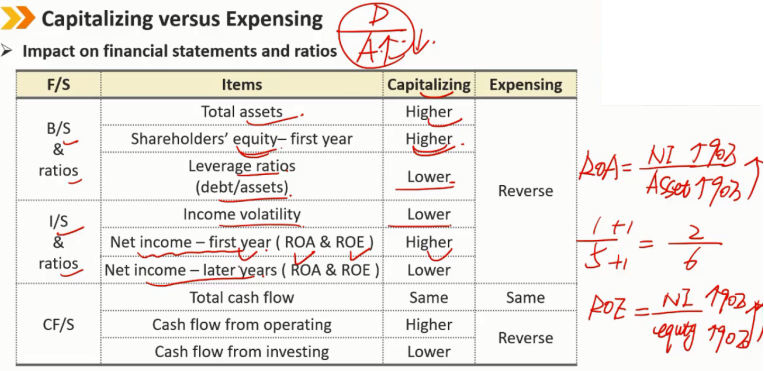

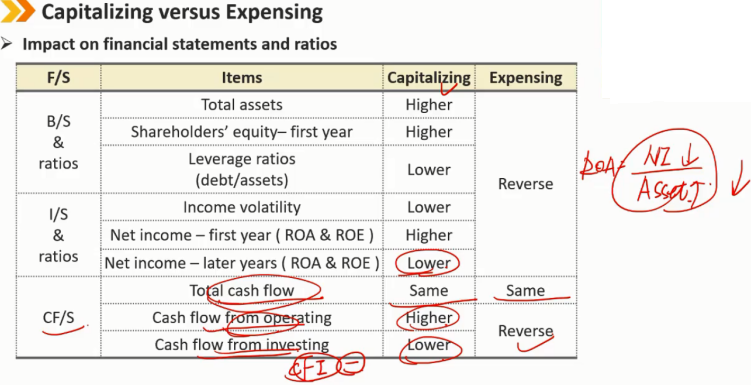

资本化对比费用化 1、资产较高 2、权益较高 3、杠杆比率较低,负债没变化,但是自己变高,导致杠杆比率变低 4、收入波动性较低,因为每年的折旧费用稳定(例如每年10万,一共折旧10年),而费用化第一年收入减少的较多(例如100万) 5、第一年末,资产折旧了10万,还剩90万,相比费用化资产多了90万;净收入减少了10万,而费用化净收入减少100万,相比之下资本化比费用化净收入多了90万,资本化相比费用化的ROA的分子分母同时加了一个相同的数,所以ROA更高

资本化对比费用化 6、后几年里,资本化因为每年都有折旧,所以NI更少,而Asset多于费用化,所以ROA低于费用化 7、现金流总值相同(都是花了100万) 8、因为资本化时购买的费用算投资性现金流CFI的流出,费用化算作经营性现金流CFO的流出,所以资本化相比费用化CFO较高,CFI较低

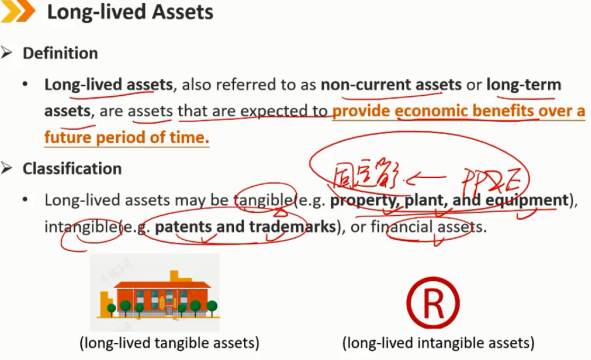

1.2 Definition

定义: - 长期资产,也称为非流动资产,是指预期在未来一段时间内提供经济利益的资产。 分类: - 长期资产可以是有形资产(固定资产 PP&E ,如房产、厂房和设备)、无形资产(如专利权和商标权)或金融资产。

1.3 Acquisition of Long-lived Tangible Assets:长期有形资产的购置

(1)When an asset is exchanged for another asset:当一项资产换成另一项资产时

The asset acquired is recorded at fair value of the asset given up unless the fair value of the asset acquired is more clearly evident.

除非收购资产的公允价值更加明显,否则收购资产按放弃资产的公允价值入账。

Typically, accounting for the exchange involves:

通常,通过交易获得的长期资产的会计核算包括:

- Removing the carrying amount of the asset given up

- 移除放弃资产的账面价值

- Adding a fair value for the asset acquired

- 增加所收购资产的公允价值

- Reporting any difference between the carrying amount and the fair value as a gain or loss

- 报告账面价值与公允价值之间的差额记为利得或者损失

(2)When property, plant, or equipment is purchased:购买房产、厂房或设备时

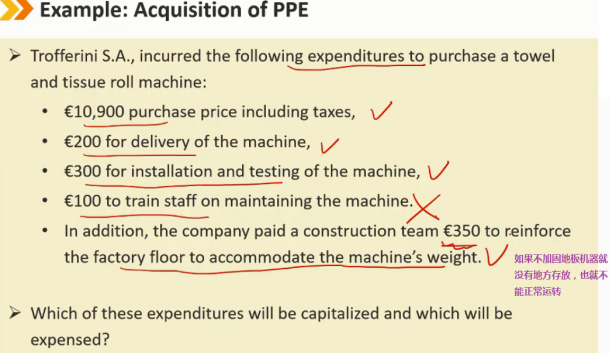

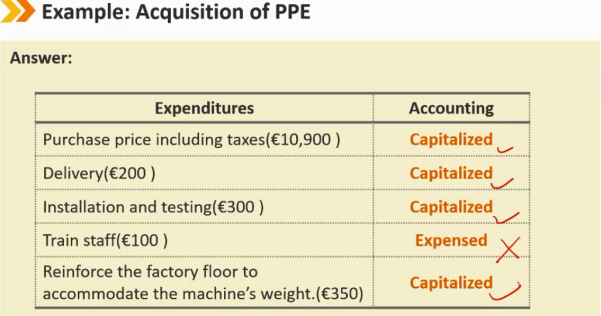

The buyer records the asset at cost. In addition to the purchase price, the buyer also includes all the expenditures necessary to get the asset ready for its intended use.

买方按成本记录资产。除购买价格外,还包括使资产达到预定用途所需的所有支出。

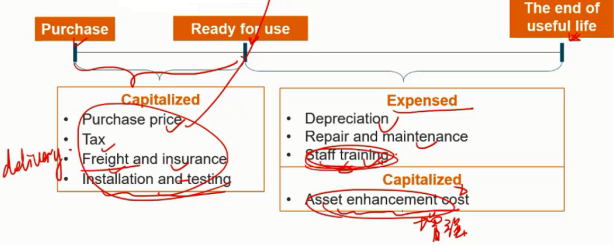

算作资本的部分:(让机器达到可使用状态的花费) 1、购买资产的价格 2、购买时交的税 3、运输费用和其过程中产生的保险费用 4、安装和调试费用 5、资产增强性费用,例如给设备换了一个更好的发动机 算作费用的部分: 1、折旧费用 2、维修和保养费用 3、员工的培训费用,因为员工即使不培训,也不影响机器的可使用状态

(3)When a company constructs an asset —> Capitalized interest costs:当一家公司建造一项资产时 —> 期间借款产生的利息成本需要资本化

Any interest costs incurred prior to the asset being ready for its intended use( for sale or for own use) are capitalized as part of the cost of the asset.

在资产达到预定用途(出售或自用)之前产生的任何利息成本作为资产成本的一部分予以资本化。

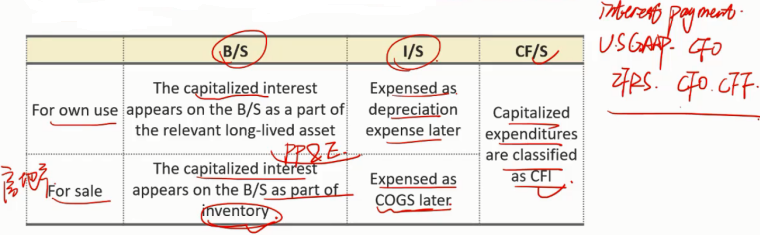

自己建造的固定资产: 1、如果是自己使用,资本化的利息体现为资产负债表中的与长期资产有关的资产的一部分,后续记为利润表的折旧费用 2、如果是建好出售的(房地产),则资本化的利息算在资产负债中存货里,随着出售,在利润表中记为COGS的费用里 3、在现金流量表中,因为固定资产的投资算CFI中,所有资本化利息也归类在CFI的支出中

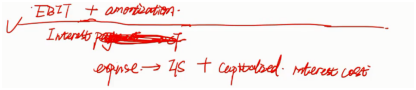

Under IFRS, but not under US.GAAP, income earned on temporarily investing the borrowed monies decreases the amount of interest costs eligible for capitalization.

根据国际会计准则,但不包括美国会计准则,临时投资借款所得收入可以抵减符合资本化条件的利息成本金额。

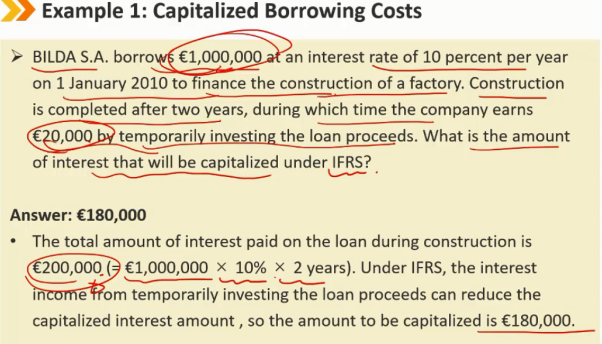

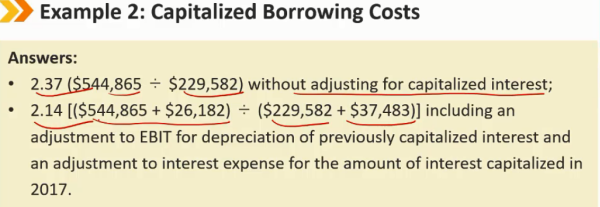

To provide a true picture of a company's interest coverage, the entire amount of interest, both the capitalized portion and the expensed portion, should be used in calculating interest coverage ratios.

为了提供公司利息覆盖率的真实情况,计算利息覆盖率时应使用全部利息金额,包括资本化部分和费用化部分。

注:计算利息覆盖率是,分母其实应该用现金流概念中的 Interest payment,但是很多时候只能拿到利润表中的Interest expense代替,因为借款购买长期资产期间产生的利息需要资本化,所以利息费用里少了这部分利息,于是分母中需要加回来被资本化的利息部分,分子中,因为当前成为资产的利息在未来还是会被摊销的,所以EBIT中需要把这部分被摊销的利息加回来

1.4 Acquisition of Long-lived Intangible Assets:长期无形资产的购置

(1)Purchased:通过购买获得无形资产

They are recorded at their fair value when acquired, which is assumed to be equivalent to the purchase price. (same as long-lived tangible assets)

这些资产按收购时的公允价值入账,假定公允价值等于购买价格。(与长期有形资产相同)

If several intangible assets are acquired as part of a group, the purchase price is allocated to each asset on the basis of its fair value.

如果若干无形资产作为一个整体被收购,则每项无形资产按照各自公允价值在总购买价中比重进行分配。

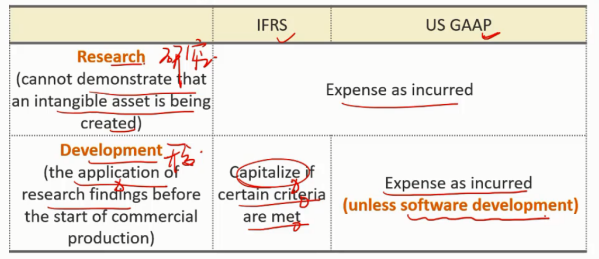

(2)Developed internally:通过自己开发这种内生的方式获得无形资产(内生)

研究阶段:都是进行费用化,因为这一阶段失败率很高

开发阶段:虽然还没有形成正式的产品,但是已经进入了研究结果的应用阶段

在国际会计准则下,一般进行费用化,但是某些具体条件已经被满足的时候,也可以进行资本化(例如有十足把握或者有明确证据表明这个项目在未来可以带来源源不断的经济效益的时候,也可以将相关开发费用进行资本化)

在美国会计准则下,还是进行费用化,除了软件开发可以进行资本化

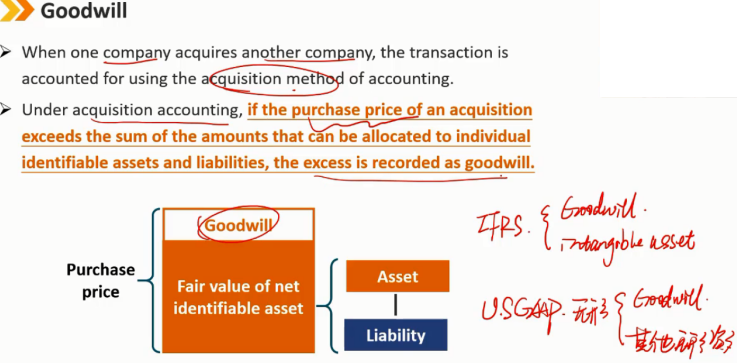

1.5 Goodwill:商誉

当一家公司收购另一家公司时,交易采用收购会计法进行会计处理。

根据收购会计法,如果收购价格超过了可分配给单个可辨认资产和负债的金额之和,则超出部分记录为商誉。

商誉为不可辨认的无形资产,即不可进行单独买卖。

2、Depreciation and Amortization of Long-lived Assets:长期资产的折旧和摊销

Under the cost model, the capitalized costs of long-lived tangible assets (other than land, which is not depreciated)and intangible assets with finite useful lives are allocated to subsequent periods as depreciation and amortisation expenses.

根据成本模型,长期有形资产(土地所有权除外,其不进行折旧)和有限使用寿命的无形资产的资本化成本作为折旧和摊销费用分配给后续期间。

Initial measurement:初始测量

- Historical costs:历史成本

Subsequent measurement:后续测量

- Carrying value/ Carrying amount/ Net book value/ Book value:账面价值

Book value = Purchase cost - Accumulated depreciation - Accumulated Impailment loss

账面价值 = 采购成本 - 累计折旧 - 累计减值损失

注:累计折旧是资产负债表的科目,折旧是利润表的科目

Depreciation Methods:折旧方法

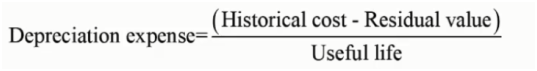

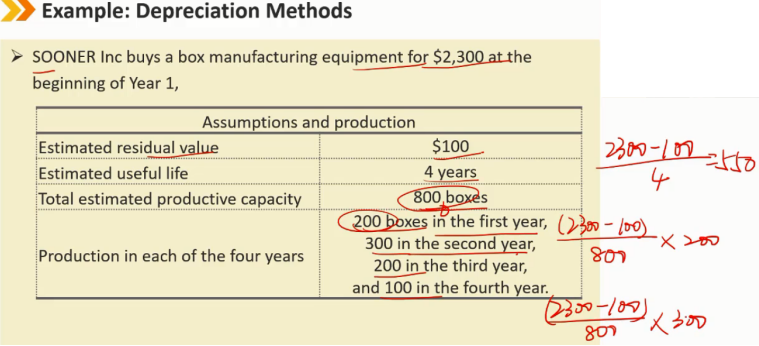

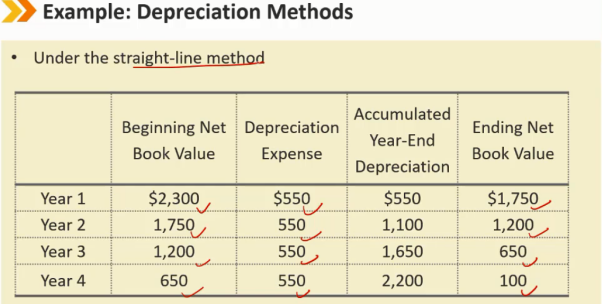

(1)Straight-line method:直线折旧法

The cost of an asset is allocated to expense evenly over its useful life.

资产的成本在其使用寿命内平均分配到费用中。

折旧费用 = (历史成本 - 残值) / 使用年限

残值:资产到期时所剩的价值

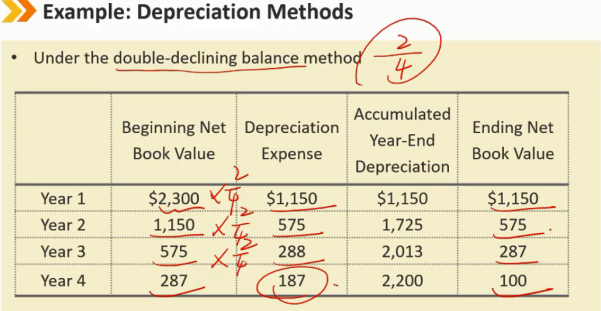

(2)Accelerated methods:加速折旧法

The allocation of cost is greater in earlier years.

前几年的折旧费用分配更大。

Declining balance method:the amount of depreciation expense for a period is calculated as some percentage of the carrying amount at the beginning of the period.

定率递减法:按期初账面价值的一定百分比计算某一期间的折旧费用金额。

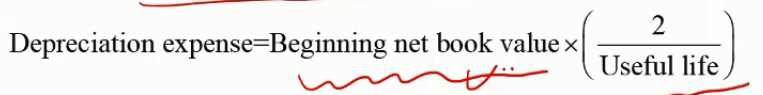

Double-declining balance method(DDB):the rate applied to the carrying amount is double the depreciation rate for the straight-line method.

双倍余额递减法(DDB):适用于账面价值折旧的比率是直线法折旧率的两倍。

折旧费用 = 期初账面价值 *(2 / 使用年限)

注:这种方式期初折旧时不考虑残值,用资产的期初账面价值进行折旧,最后一期再考虑残值。

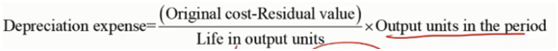

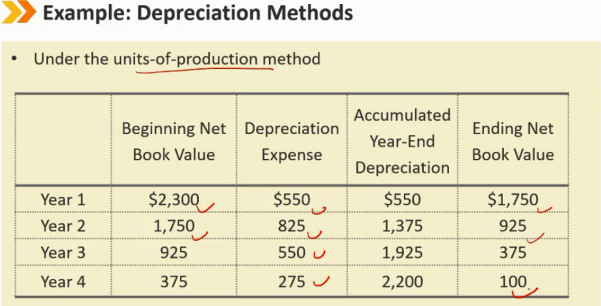

(3)Units-of-production method:产量折旧法

The allocation of cost corresponds to the actual use of an asset in a particular period.

折旧分配与特定时期内资产的实际使用量相对应。

折旧费用 = (历史成本 - 残值)/ 使用年限内的预计产量 * 当前期间的产量

注:预计产量是指在我们手中预计可以生产的总产量,而不是这个设备可以生产的最大产量

注:这种方式期初折旧时不考虑残值,用资产的期初账面价值进行折旧,最后一期再考虑残值

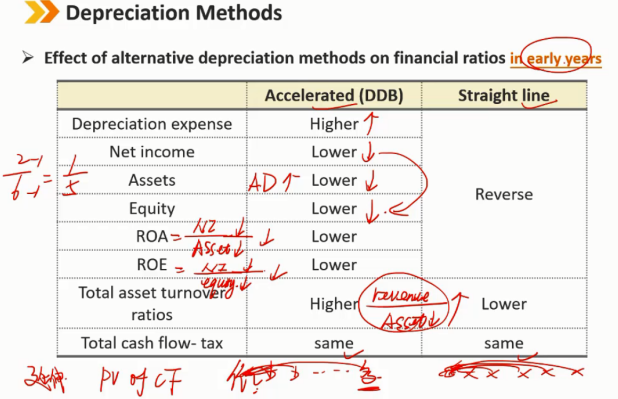

(4)Effect of alternative depreciation methods on financial ratios in early years:不同折旧方法对早期财务比率的影响

加速折旧法和直线折旧法所交的税是一样的,但是根据现金流折现的角度来看,加速折旧法折现的金额更少

(5)Influence of assumptions:假设的影响

longer useful life and higher expected residual value decrease the amount of annual depreciation expense relative to a shorter useful life and lower expected residual value.

与更短的使用寿命和更低的预期残值相比,更长的使用寿命和更高的预期残值会减少年度折旧费用。

Companies should review their estimates periodically to ensure they remain reasonable.

公司应定期审查其估算,以确保其保持合理。

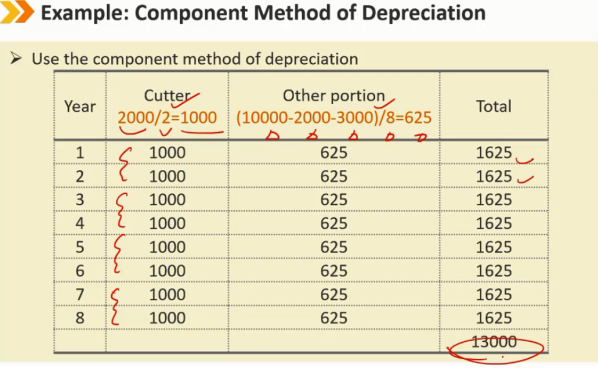

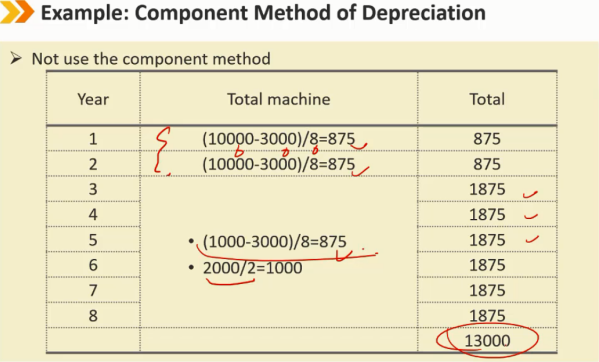

(6)Component method of depreciation:组件折旧法

IFRS require companies to use a component method of depreciation to separately depreciate the significant components of an asset.

国际会计准则要求各公司使用组件折旧法对资产的重要组成部分进行单独折旧。

Under US GAAP, the component method of depreciation is allowed but is seldom used in practice.

美国会计原则允许采用组件折旧法,但在实际中很少使用。

使用组件折旧法结合直线折旧法

没有采用组件折旧法,将最先开始的机器和刀算做一个整体,2年后每年加入1000的刀的折旧费用

3、Impairment of Long-lived Assets:长期资产的减值

In contrast with depreciation and amortization charges, impairment charges reflect an unanticipated decline in the value of an asset.

折旧和摊销是预料之内的费用,但是减值是预料之外的费用

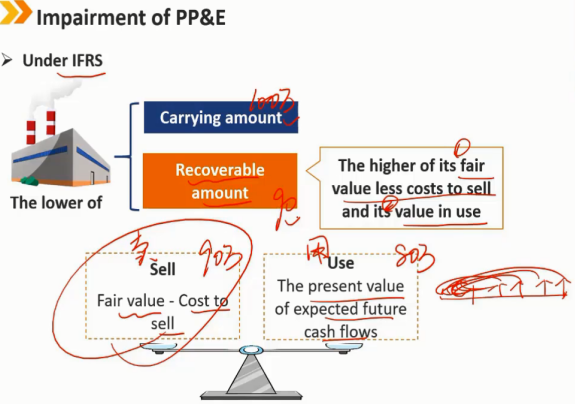

3.1 Impairment of PP&E:固定资产的减值

注:用于出售的房地产的减值适用于存货的减值方法,因为其已经归于存货科目

Testing:减值测试

- If there is an indication of impairment, such as evidence of obsolescence, decline in demand for products, or technological advancements, the recoverable amount of the asset should be measured in order to test for impairment.

- 如果存在减值迹象,例如过时、产品需求下降或技术进步的证据,则应计量资产的可收回金额,以测试减值。

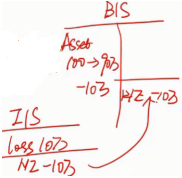

Accounting:会计报表处理

- When the asset's carrying amount is more than the recoverable amount, the amount of the impairment loss will reduce the carrying amount of the asset on the balance sheet and will reduce net income on the income statement.

- 当资产的账面价值大于可收回金额时,减值损失的金额将减少资产负债表上资产的账面价值,并减少利润表上的净收入。

- The impairment loss is a non-cash item.

- 减值损失为非现金项目,不影响现金流量表。

A new depreciation schedule based on the new carrying amount would be developed.

将根据新的账面价值制定新的折旧计划。

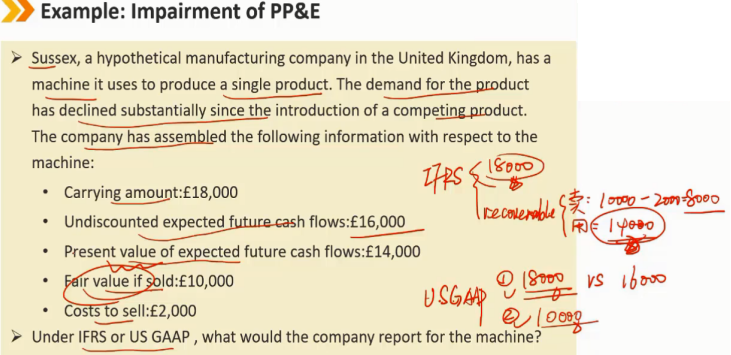

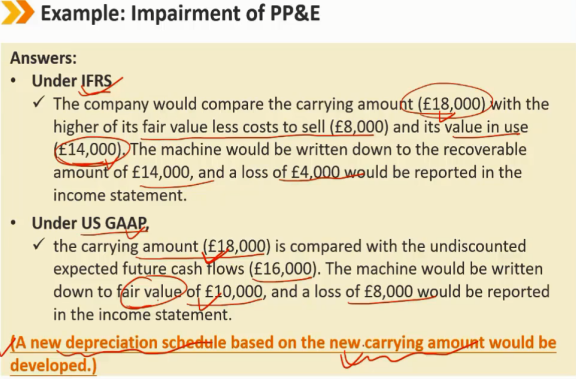

国际会计准则下:

可回收金额取 公允价值减去出售所需相关成本之后的价值 与 继续使用的价值(未来能够带来的现金流的现值) 两者之间的较高值

新账面价值取 原账面价值 和 可回收金额 两者的较低值

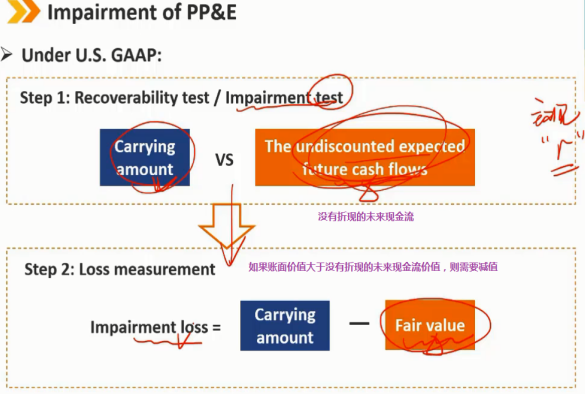

在美国会计准则下:

第1步:比较 账面价值 和 没有折现的未来现金流,如果比没有折现的未来现金还大,则需要减值,这样比未来现金流折现更为严格

第2步:减值损失 = 账面价值 - 公允价值,新账面价值记为公允价值(可以通过未来现金流折现计算出来)

3.2 Impairment of intangible assets:无形资产的减值

Testing:减值测试

- Intangible assets with a finite life:They are tested only when significant events suggest the need to test. (same as for tangible assets)

- 有限期的无形资产(需要摊销):只有当重大事件表明需要减值时,才会对其进行减值测试。(与有形资产相同)

- Intangible assets with indefinite lives:They are carried on the balance sheet at historical cost but are tested at least annually for impairment. Impairment exists when the carrying amount exceeds its fair value.

- 无限期的无形资产(不摊销):按历史成本计入资产负债表,但至少每年进行一次减值测试。当账面价值超过其公允价值时,需要减值。

Accounting:会计报表处理

- The amount of the impairment loss will reduce the carrying amount of the asset on B/S and will reduce net income on I/S.

- 减值损失的金额将减少资产负债表上资产的账面价值,并减少利润表的净收入。

3.3 Impairment of long-lived assets held for sale:可供出售的长期资产的减值

A long-lived asset is reclassified as held for sale when management's intent is to sell it and its sale is highly probable.

当管理层打算出售一项长期资产且其出售的可能性很大时,该资产将被重新分类为可供出售的长期资产。(可以看成是 PP&E的一个末尾形态)

Testing:减值测试

- At the time of reclassification, assets previously held for use are tested for impairment.

- 在重新分类时,对先前持有以供使用的资产进行减值测试。

Accounting:会计报表处理

- If the carrying amount at the time of reclassification exceeds the fair value less costs to sell, an impairment loss is recognised and the asset is written down to fair value less costs to sell.

- 如果重新分类时的资产的账面价值超过公允价值减去其相应出售成本,则确认减值损失,并将资产减值为公允价值减去相应出售成本。

- Long-lived assets held for sale cease to be depreciated or amortised.

- 可供出售的长期资产需终止折旧或摊销。

3.4 Reversals of impairments of long-lived assets:长期资产减值之后的回转

例如:购买了一项专利,后来这项专利卷入到了抄袭的官司中,此时需要对其进行减值,再后来官司打赢了,此时面临减值之后的回转

注:对于房地产企业建造的用于出售的房屋资产,归类为存货,适用于存货的减值方法,不用长期资产的减值方法处理

Under IFRS:国际会计准则下

Permit impairment losses to be reversed whether the asset is classified as held for use or held for sale.

无论是持有自用还是可供出售的长期资产,都允许对减值损失进行回转。

Permit the reversal of impairment losses only.

仅允许转回减值损失的金额。

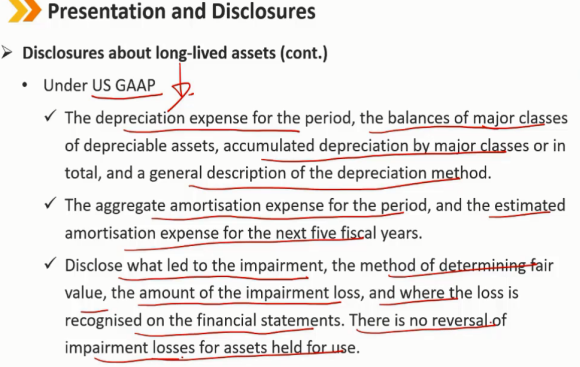

Under US GAAP:美国会计准则下

Assets held for use cannot be reversed.

持有自用的资产不能回转。

Assets held for sale can be reversed.

可供出售的资产可以回转。

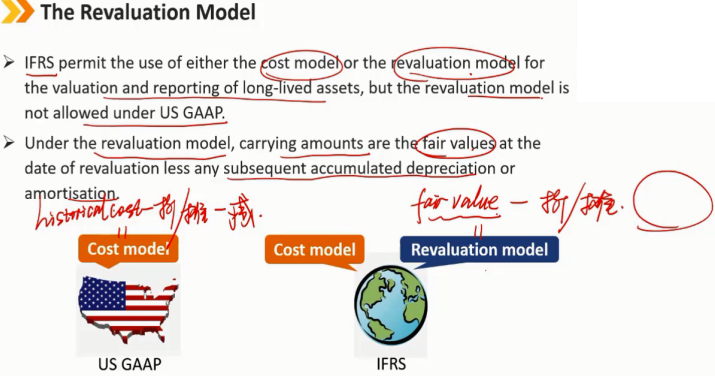

4、The Revaluation Model:重估模型

Cost model 下 carrying amount = historical cost - 累计折旧/摊销 - 减值

Revaluation model 下 carrying amount = fair value - 累计折旧/摊销

IFRS允许使用成本模型或重估模型对长期资产进行估价和报告,但根据美国会计准则,重估模型是不允许的。

在重估模型下,账面价值是重估日期的公允价值减去任何后续累计折旧或摊销。

A key difference between the two models is that the cost model allows only decreases in the values of long-lived assets compared with historical costs but the revaluation model may result in increases in the values of long-lived assets to amounts greater than historical costs.

这两种模型之间的一个关键区别是,成本模型只允许长期资产的价值与历史成本相比有所下降,但重估模型可能导致长期资产价值的上升幅度大于历史成本。(当重估出来的fair value很大的时候)

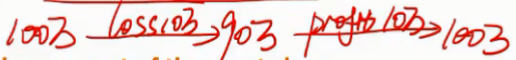

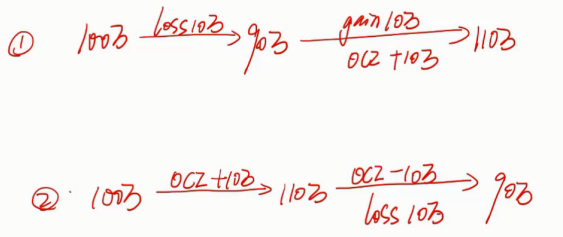

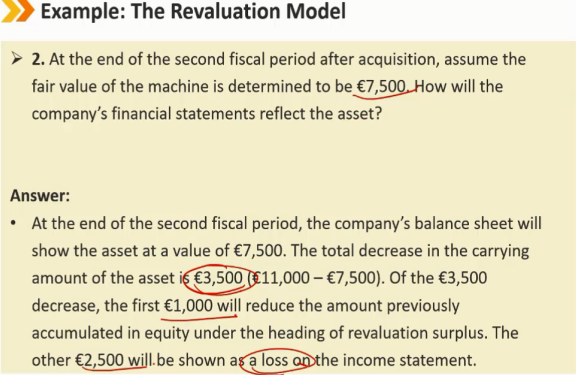

If a revaluation initially decreases the carrying amount of the asset class, the decrease is recognized in loss. Later, if the asset's value increases, the increase is recognized in profit to the extent that the same asset class previously recognized in loss.

如果重估最初减少了资产类别的账面价值,则减少的金额确认为利润表中的损失。之后,如果资产价值增加,则增加的金额在之前确认为损失的相同资产类别的范围内确认为利润。

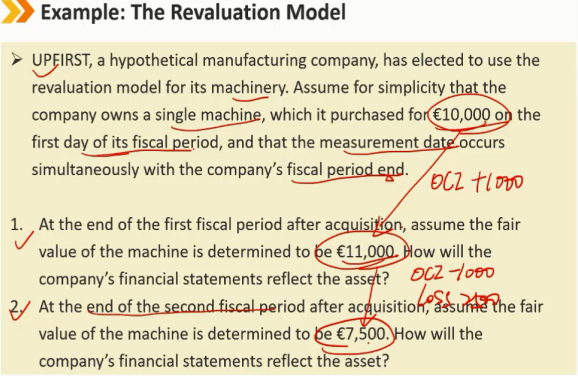

If a revaluation initially increases the carrying amount of the asset class, the increase will be recorded directly to equity in a revaluation surplus account. Any subsequent decrease in the asset's value first decreases the revaluation surplus and then goes to income.

如果重估最初增加了资产类别的账面价值,则增加的金额将直接计入权益中的累计其他收入(A.OCI)中的重估盈余账户科目。资产价值的任何后续减少首先抵减重估盈余账户的金额,如果不够再从利润表中抵减。

IFRS allow a company to use the cost model for some classes of assets and the revaluation model for others, but the company must apply the same model to all assets within a particular class of assets and must revalue all items within a class to avoid selective revaluation.

IFRS允许公司对某些类别的资产使用成本模型,对其他类别的资产使用重估模型,但公司必须对特定类别的资产中的所有资产应用相同的模型,并且必须对某一类别中的所有项目进行重估,以避免选择性重估。

An increase in the carrying amount of depreciable long-lived assets increases total assets and shareholders'equity, so asset revaluations that increase the carrying amount of an asset can be used to reduce reported leverage.

可折旧长期资产账面价值的增加会增加总资产和股东权益,因此增加资产账面价值的资产重估可用于降低报告的杠杆率。

5、Derecognition:长期资产的处置

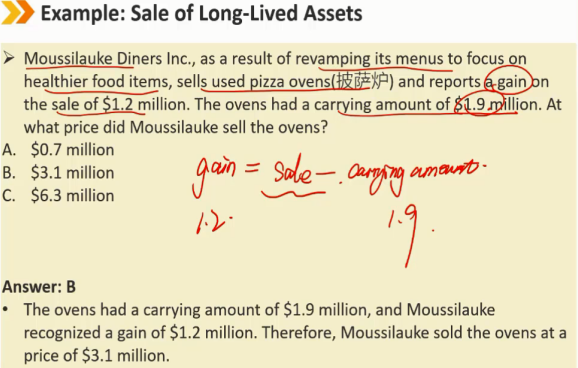

(1)Long-lived asset is sold:长期资产被出售(PP&E -> held for sale)

- Difference between the sale proceeds and the carrying value of the asset is reported as a gain or loss.

销售收入与资产账面价值之间的差额作为损益报告。

(2)Long-lived asset is abandoned:长期资产被废弃

- Carrying value is removed from the B/S, loss is recognized in income statement.

账面价值从资产负债表中移除,损失在利润表中确认。

(3)Long-lived asset is exchanged:长期资产被交换

- Removing the carrying amount of the asset given up, adding a fair value for the asset acquired, and reporting any difference between the carrying amount and the fair value as a gain or loss.

移除放弃资产的账面价值,增加所收购资产的公允价值,并将账面价值与公允价值之间的任何差异作为损益进行报告。

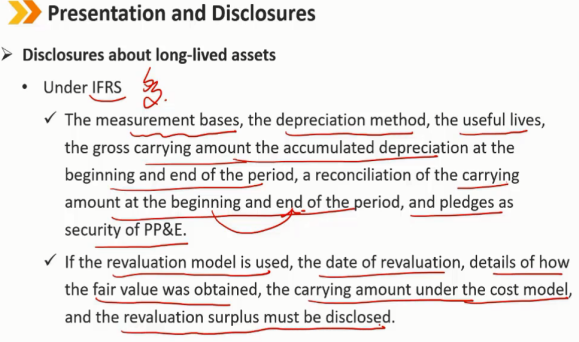

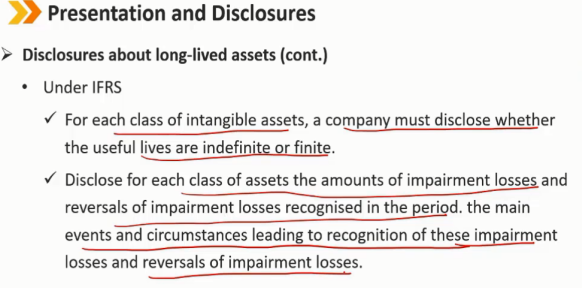

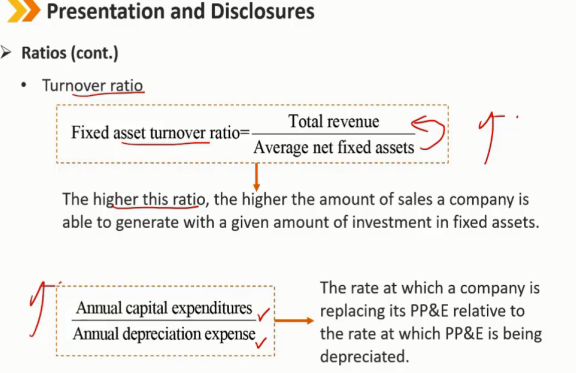

6、Presentation and Disclosures:长期资产的披露

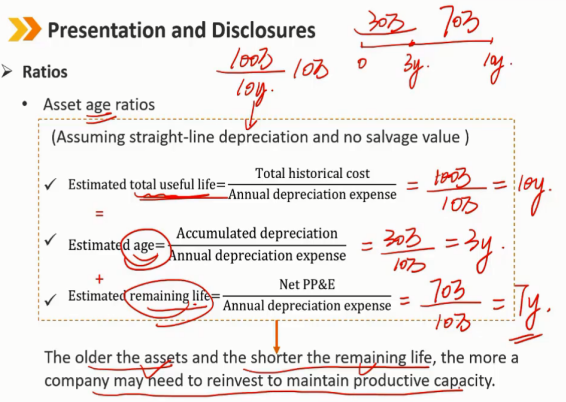

美国会计准则下不要求披露长期资产的使用年限,所以需要自己估计长期资产的使用年限:

7、Investment Property:投资性房地产

Investment property is defined under IFRS as property that is for the purpose of earning rentals or capital appreciation or both.

国际会计准则将投资性房地产定义为以赚取租金或资本保值增值或两者兼有为目的的房地产。

Under US GAAP there is no specific definition of investment property.

在美国会计准则下,没有投资性房地产这一分类。

注:普通企业也可以拥有投资性房地产

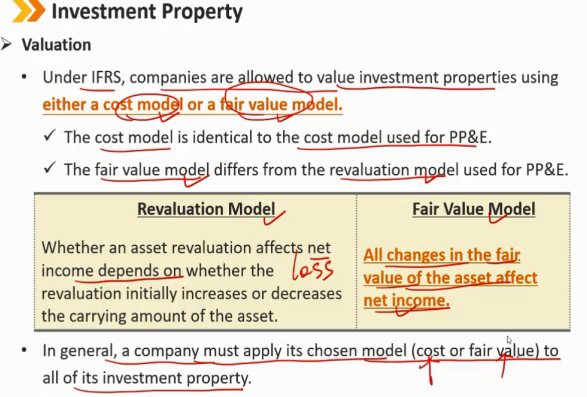

公司只能选择 cost model 或 fair model 中的一种模型来对投资性房地产进行估值

revaluation model 和 fair value model 的区别:

revaluation model 中的loss会影响net income,而gain只会计入OCI中影响equity

fair value model 中的gain和loss都影响net income

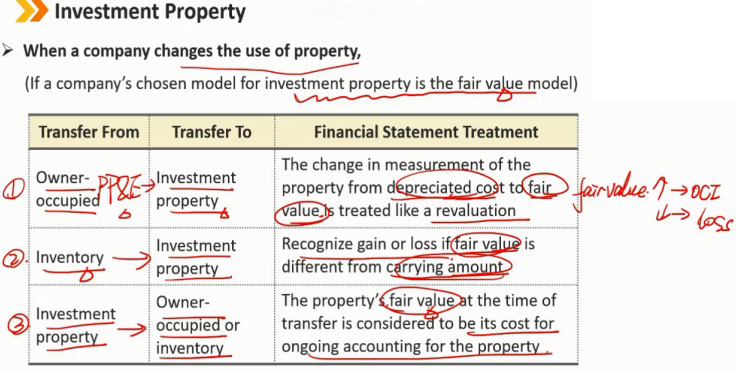

当一个公司改变了其房地产的用途时,特别是对投资性房地产使用fair value model的情况下: 1、owner-occupied(自住型)转为投资性房地产:对于价差部分按revaluation model的方式记录,如果fair value高于折旧后成本,gain记录到OCI中,如果fair value低于成本,在利润表中记录loss 2、inventory(出售型)转为投资性房地产:之间将fair value和账面价值之间的gain或loss记录到利润表中 3、投资性房地产转为owner-occupied或inventory:在转换那个时刻的fair value就作为这项房产的初始成本

Summary:

浙公网安备 33010602011771号

浙公网安备 33010602011771号