量化交易

量化交易(Quantitative Trading)也可以理解为高频交易,是利用数学模型、统计学方法和计算机编程来进行金融交易的一种策略。

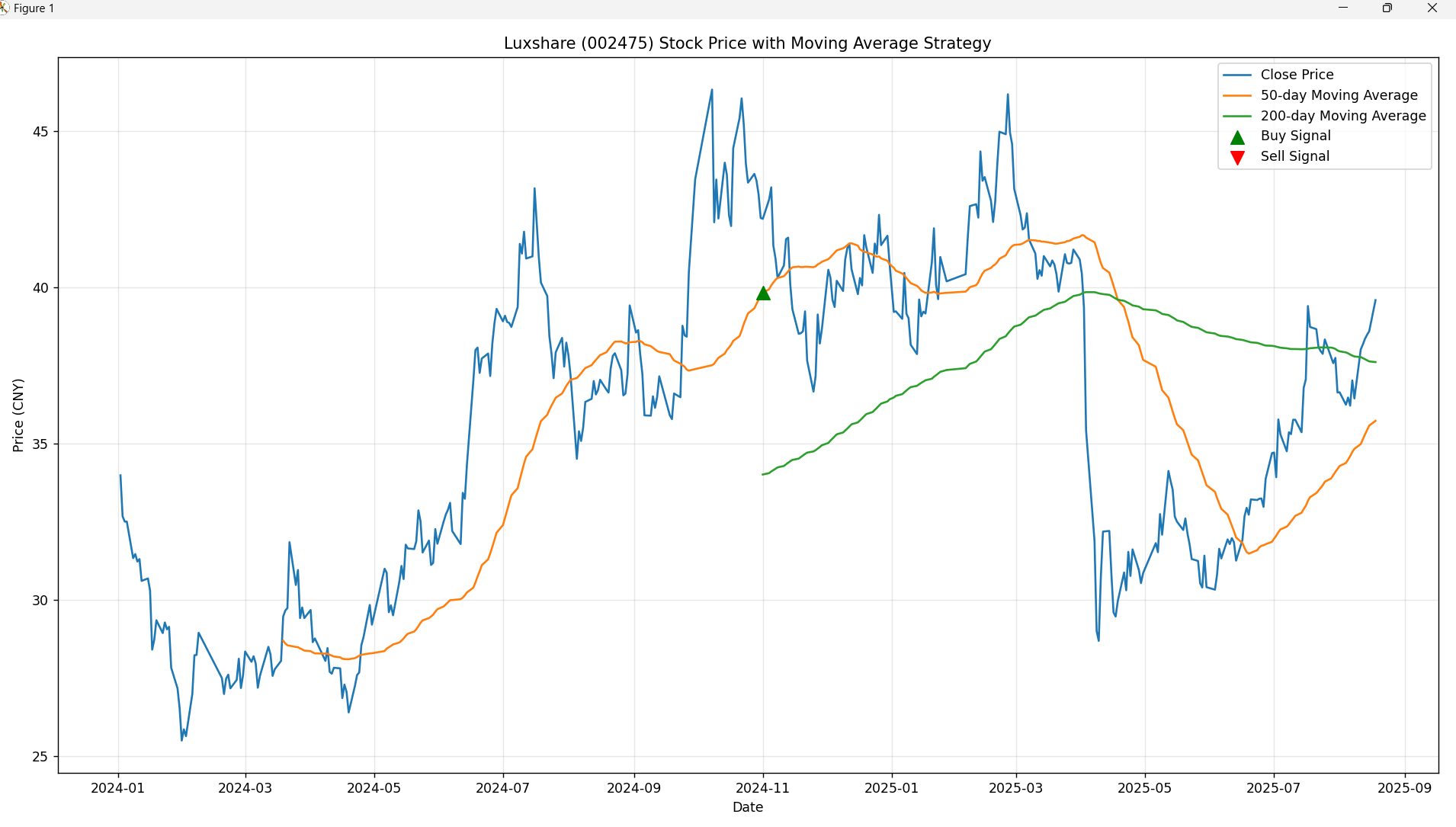

移动平均交叉策略

import requests import pandas as pd import matplotlib.pyplot as plt import ssl def get_stock_data_eastmoney(stock_code, start_date, end_date): """ Fetch historical stock data from Eastmoney.com Parameters: stock_code (str): Stock code, e.g. '002475' start_date (str): Start date in format 'YYYY-MM-DD' end_date (str): End date in format 'YYYY-MM-DD' Returns: DataFrame: DataFrame containing historical stock data """ # Eastmoney API url = f"http://push2his.eastmoney.com/api/qt/stock/kline/get" # Handle stock code prefix if stock_code.startswith(('6', '5')): market_prefix = '1.' # Shanghai market else: market_prefix = '0.' # Shenzhen market secid = f"{market_prefix}{stock_code}" # Request parameters params = { "secid": secid, "ut": "fa5fd1943c7b386f1734de82369f10d", "fields1": "f1,f2,f3,f4,f5,f6", "fields2": "f51,f52,f53,f54,f55,f56,f57,f58,f59,f60,f61", "klt": "101", # Daily K-line "fqt": "0", # No adjustment "beg": start_date.replace('-', ''), "end": end_date.replace('-', '') } # Set request headers headers = { "User-Agent": "Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/91.0.4472.124 Safari/537.36" } try: # Bypass SSL verification (handle corporate network issues) ssl._create_default_https_context = ssl._create_unverified_context # Send request response = requests.get(url, params=params, headers=headers) response.raise_for_status() data = response.json() if data.get('data') and 'klines' in data['data']: # Parse K-line data klines = data['data']['klines'] if not klines: print(f"Retrieved K-line data is empty") return None # Create DataFrame df = pd.DataFrame([kline.split(',')[:7] for kline in klines], columns=['Date', 'Open', 'Close', 'High', 'Low', 'Volume', 'Turnover']) # Convert data types numeric_columns = ['Open', 'Close', 'High', 'Low', 'Volume', 'Turnover'] df[numeric_columns] = df[numeric_columns].apply(pd.to_numeric) # Convert date column to datetime type df['Date'] = pd.to_datetime(df['Date']) # Set date as index df.set_index('Date', inplace=True) return df else: print(f"Failed to retrieve data for stock {stock_code}: {data.get('msg', 'Unknown error')}") return None except requests.exceptions.RequestException as e: print(f"Request exception for stock {stock_code}: {e}") return None except Exception as e: print(f"Error processing stock {stock_code}: {e}") return None # Get Luxshare stock data symbol = "002475" start_date = "2020-01-01" end_date = "2025-08-18" print(f"Fetching stock {symbol} data from {start_date} to {end_date}...") data = get_stock_data_eastmoney(symbol, start_date, end_date) if data is not None and not data.empty: print("Data retrieved successfully!") # Use 'Close' column for calculations close_column = 'Close' # Calculate short-term (50-day) and long-term (200-day) moving averages data['MA_50'] = data[close_column].rolling(window=50).mean() data['MA_200'] = data[close_column].rolling(window=200).mean() # Generate buy/sell signals data['Signal'] = 0 data['Signal'][data['MA_50'] > data['MA_200']] = 1 # Short-term MA crosses above long-term MA, generate buy signal data['Signal'][data['MA_50'] < data['MA_200']] = -1 # Short-term MA crosses below long-term MA, generate sell signal # To better display buy/sell signals, find signal change points data['Position'] = data['Signal'].diff() # Plot stock price and moving averages plt.figure(figsize=(14, 8)) plt.plot(data[close_column], label='Close Price') plt.plot(data['MA_50'], label='50-day Moving Average') plt.plot(data['MA_200'], label='200-day Moving Average') # Mark buy/sell signals buy_signals = data[data['Position'] == 1] sell_signals = data[data['Position'] == -1] plt.scatter(buy_signals.index, buy_signals['MA_50'], marker='^', color='g', s=100, label='Buy Signal', zorder=5) plt.scatter(sell_signals.index, sell_signals['MA_50'], marker='v', color='r', s=100, label='Sell Signal', zorder=5) plt.title(f"Luxshare ({symbol}) Stock Price with Moving Average Strategy") plt.xlabel("Date") plt.ylabel("Price (CNY)") plt.legend() plt.grid(True, alpha=0.3) plt.tight_layout() plt.show() # Display basic data statistics print("\nBasic Data Statistics:") print(data[[close_column, 'MA_50', 'MA_200', 'Signal']].describe()) # Display recent buy/sell signals print("\nRecent Buy/Sell Signals:") recent_signals = data[data['Position'] != 0].tail(10) for date, row in recent_signals.iterrows(): signal_type = "Buy" if row['Position'] == 1 else "Sell" print(f"{date.date()}: {signal_type} Signal - Price: {row[close_column]:.2f}") # Display current status if not data.empty: latest = data.iloc[-1] print(f"\nCurrent Status:") print(f"Current Price: {latest[close_column]:.2f}") print(f"50-day MA: {latest['MA_50']:.2f}") print(f"200-day MA: {latest['MA_200']:.2f}") print(f"Current Signal: {'Hold' if latest['Signal'] == 1 else 'No Position'}") else: print("Failed to retrieve valid data")

这里计算出40是买点,感觉也不大准啊

量化交易基本策略

量化交易基于数学模型、统计学和计算机算法,通过系统性的方法识别和执行交易机会。

以下是一些常见的量化交易基本策略:

量化交易基于数学模型、统计学和计算机算法,通过系统性的方法识别和执行交易机会。

以下是一些常见的量化交易基本策略:

1. 移动平均策略

-

策略思想: 基于股价的历史平均值,通过计算短期和长期移动平均线之间的差异来产生买卖信号。

-

实现方式: 计算短期和长期移动平均,当短期均线上穿长期均线时产生买入信号,反之产生卖出信号。

2. 均值回归策略

-

策略思想: 基于价格的历史波动,认为价格在波动后会回归到其平均水平。

-

实现方式: 通过计算价格与均值之间的差异,当价格偏离均值过多时产生买入或卖出信号。

3. 动量策略

-

策略思想: 基于价格的趋势,认为价格趋势会延续一段时间。

-

实现方式: 通过计算价格的变化率或其他趋势指标,产生买入或卖出信号。

4. 市场中性策略

-

策略思想: 通过同时进行买入和卖出,以利用市场的相对强弱。

-

实现方式: 基于两个或多个相关资产之间的价差或相关性,产生交易信号。

5. 统计套利策略

-

策略思想: 基于统计学原理,寻找价格之间的临时不平衡,以实现套利。

-

实现方式: 通过寻找价格、波动性或其他统计指标的异常值,产生交易信号。

6. 事件驱动策略

-

策略思想: 基于特定事件或信息的发生,产生交易信号。

-

实现方式: 监控新闻、财报、经济指标等,当发生特定事件时执行交易。

7. 机器学习策略

-

策略思想: 利用机器学习算法从大量数据中学习模式,预测未来价格走势。

-

实现方式: 使用回归、分类或深度学习模型,训练模型预测市场走势。

8. 高频交易策略

-

策略思想: 通过快速执行大量交易来利用极短时间内的小价差。

-

实现方式: 使用高性能算法和快速执行系统,通常涉及大量交易和低持仓时间。

中国 A 股的股票代码需要加上交易所的后缀,上海证券交易所(SSE)的后缀是 .SS,深圳证券交易所(SZSE)的后缀是 .SZ。

量化回测:

通过回测,交易者可以了解其策略在不同市场条件下的表现,并进行优化和改进。

import requests import pandas as pd import matplotlib.pyplot as plt import ssl def get_stock_data_eastmoney(stock_code, start_date, end_date): """ Fetch historical stock data from Eastmoney.com Parameters: stock_code (str): Stock code, e.g. '002475' start_date (str): Start date in format 'YYYY-MM-DD' end_date (str): End date in format 'YYYY-MM-DD' Returns: DataFrame: DataFrame containing historical stock data """ # Eastmoney API url = f"http://push2his.eastmoney.com/api/qt/stock/kline/get" # Handle stock code prefix if stock_code.startswith(('6', '5')): market_prefix = '1.' # Shanghai market else: market_prefix = '0.' # Shenzhen market secid = f"{market_prefix}{stock_code}" # Request parameters params = { "secid": secid, "ut": "fa5fd1943c7b386f1734de82369f10d", "fields1": "f1,f2,f3,f4,f5,f6", "fields2": "f51,f52,f53,f54,f55,f56,f57,f58,f59,f60,f61", "klt": "101", # Daily K-line "fqt": "0", # No adjustment "beg": start_date.replace('-', ''), "end": end_date.replace('-', '') } # Set request headers headers = { "User-Agent": "Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/91.0.4472.124 Safari/537.36" } try: # Bypass SSL verification (handle corporate network issues) ssl._create_default_https_context = ssl._create_unverified_context # Send request response = requests.get(url, params=params, headers=headers) response.raise_for_status() data = response.json() if data.get('data') and 'klines' in data['data']: # Parse K-line data klines = data['data']['klines'] if not klines: print(f"Retrieved K-line data is empty") return None # Create DataFrame df = pd.DataFrame([kline.split(',')[:7] for kline in klines], columns=['Date', 'Open', 'Close', 'High', 'Low', 'Volume', 'Turnover']) # Convert data types numeric_columns = ['Open', 'Close', 'High', 'Low', 'Volume', 'Turnover'] df[numeric_columns] = df[numeric_columns].apply(pd.to_numeric) # Convert date column to datetime type df['Date'] = pd.to_datetime(df['Date']) # Set date as index df.set_index('Date', inplace=True) return df else: print(f"Failed to retrieve data for stock {stock_code}: {data.get('msg', 'Unknown error')}") return None except requests.exceptions.RequestException as e: print(f"Request exception for stock {stock_code}: {e}") return None except Exception as e: print(f"Error processing stock {stock_code}: {e}") return None # Get Luxshare stock data for detailed analysis symbol = "002475" start_date = "2022-01-01" end_date = "2025-08-18" print(f"Fetching stock {symbol} data from {start_date} to {end_date} for detailed analysis...") data = get_stock_data_eastmoney(symbol, start_date, end_date) if data is not None and not data.empty: print("Data retrieved successfully! Performing detailed analysis...") # Use 'Close' column for calculations close_column = 'Close' # Calculate moving averages data['SMA_50'] = data[close_column].rolling(window=50).mean() data['SMA_200'] = data[close_column].rolling(window=200).mean() # Initialize signal column data['Signal'] = 0 # Calculate crossover signals data.loc[data['SMA_50'] > data['SMA_200'], 'Signal'] = 1 data.loc[data['SMA_50'] < data['SMA_200'], 'Signal'] = -1 # Calculate daily returns data['Daily_Return'] = data[close_column].pct_change() # Calculate strategy returns (shift(1) to avoid look-ahead bias) data['Strategy_Return'] = data['Signal'].shift(1) * data['Daily_Return'] # Calculate cumulative returns data['Cumulative_Return'] = (1 + data['Strategy_Return']).cumprod() # Calculate buy and hold cumulative returns for comparison data['Buy_Hold_Return'] = (1 + data['Daily_Return']).cumprod() # Find trade signals data['Position'] = data['Signal'].diff() # Detailed analysis print("=== Detailed Strategy Analysis ===") # Price change analysis initial_price = data[close_column].iloc[0] final_price = data[close_column].iloc[-1] price_change = (final_price / initial_price) - 1 print(f"Initial Price: {initial_price:.2f}") print(f"Final Price: {final_price:.2f}") print(f"Price Change: {price_change:.2%}") # Strategy performance strategy_return = data['Cumulative_Return'].iloc[-1] - 1 buy_hold_return = data['Buy_Hold_Return'].iloc[-1] - 1 print(f"\nStrategy Return: {strategy_return:.2%}") print(f"Buy & Hold Return: {buy_hold_return:.2%}") # Signal timing analysis print(f"\n=== Signal Timing Analysis ===") signals = data[data['Position'] != 0].copy() if len(signals) > 0: print("Recent Trade Signals:") for date, row in signals.tail(10).iterrows(): signal_type = "BUY" if row['Position'] == 1 else "SELL" print(f"{date.date()}: {signal_type} at price {row[close_column]:.2f}") # Check if we're currently holding current_signal = data['Signal'].iloc[-1] print(f"\nCurrent Position: {'HOLDING' if current_signal == 1 else 'NOT HOLDING'}") # Period by period analysis print(f"\n=== Key Period Analysis ===") # Find when strategy was holding vs not holding holding_periods = data[data['Signal'] == 1] not_holding_periods = data[data['Signal'] == -1] if len(holding_periods) > 0: holding_return = (holding_periods['Daily_Return'] + 1).prod() - 1 print(f"Return during holding periods: {holding_return:.2%}") print(f"Total holding days: {len(holding_periods)}") if len(not_holding_periods) > 0: not_holding_return = (not_holding_periods['Daily_Return'] + 1).prod() - 1 print(f"Return during non-holding periods: {not_holding_return:.2%}") print(f"Total non-holding days: {len(not_holding_periods)}") # Drawdown analysis data['Strategy_Drawdown'] = (data['Cumulative_Return'] / data['Cumulative_Return'].cummax()) - 1 data['Buy_Hold_Drawdown'] = (data['Buy_Hold_Return'] / data['Buy_Hold_Return'].cummax()) - 1 max_strategy_drawdown = data['Strategy_Drawdown'].min() max_buy_hold_drawdown = data['Buy_Hold_Drawdown'].min() print(f"\n=== Drawdown Analysis ===") print(f"Maximum Strategy Drawdown: {max_strategy_drawdown:.2%}") print(f"Maximum Buy & Hold Drawdown: {max_buy_hold_drawdown:.2%}") # Plot detailed chart fig, (ax1, ax2) = plt.subplots(2, 1, figsize=(14, 10)) # Price and signals plot ax1.plot(data.index, data[close_column], label='Close Price', linewidth=1) ax1.plot(data.index, data['SMA_50'], label='50-day MA', alpha=0.7) ax1.plot(data.index, data['SMA_200'], label='200-day MA', alpha=0.7) # Mark buy/sell signals buy_signals = data[data['Position'] == 1] sell_signals = data[data['Position'] == -1] ax1.scatter(buy_signals.index, buy_signals[close_column], marker='^', color='green', s=100, label='Buy Signal', zorder=5) ax1.scatter(sell_signals.index, sell_signals[close_column], marker='v', color='red', s=100, label='Sell Signal', zorder=5) ax1.set_title(f'{symbol} Price and Trading Signals') ax1.set_ylabel('Price') ax1.legend() ax1.grid(True, alpha=0.3) # Returns comparison plot ax2.plot(data.index, data['Cumulative_Return'], label='Strategy Return', color='blue') ax2.plot(data.index, data['Buy_Hold_Return'], label='Buy & Hold Return', color='green') ax2.set_title('Cumulative Returns Comparison') ax2.set_ylabel('Cumulative Return') ax2.set_xlabel('Date') ax2.legend() ax2.grid(True, alpha=0.3) plt.tight_layout() plt.show() else: print("Failed to retrieve valid data for analysis")

根据日均线策略,结果回测收益亏的一塌糊涂。

浙公网安备 33010602011771号

浙公网安备 33010602011771号