债券及衍生品分析计算示例

债券分析

基础计算

日期计算

#先使用to_datetime把某一列的格式转换为日期

df['maturity_date'] = pd.to_datetime(df['maturity_date'])

df_coupon['b.coupon_obtain_date'] = pd.to_datetime(df_coupon['b.coupon_obtain_date'])

#转化为日期之后的两列可以直接相减,得到相差的天数,但是天数不能直接与数值作比较:

df['date_diff'] = df['maturity_date']-df['value_date']

df['date_diff'] = df['date_diff'].dt.days

债券利息的计算

债券的计息基准与应计利息的计算(非常详细):https://mp.weixin.qq.com/s/1j1-LaVTRB-CkuFr1B1log

债券的损益分解(Carry roll-down与PL)

https://zhuanlan.zhihu.com/p/348301609

其它计算

ANALYSING_A_BOND

FIXED_BOND_PRICER (Python code)

https://github.com/max-fitzpatrick/bond_pricer/blob/master/FIXED_BOND_PRICER.ipynb

BondPortOptimization

https://github.com/nakulnayyar/BondPortOptimization/blob/gh-pages/Bond Momentum Rebalance.ipynb

组合管理网上课程

https://www.udemy.com/course/investment-analysis-portfolio-management-with-python/

衍生品分析

利率互换计算

【案例一】计算利率互换价值的函数

https://zhuanlan.zhihu.com/p/163607169

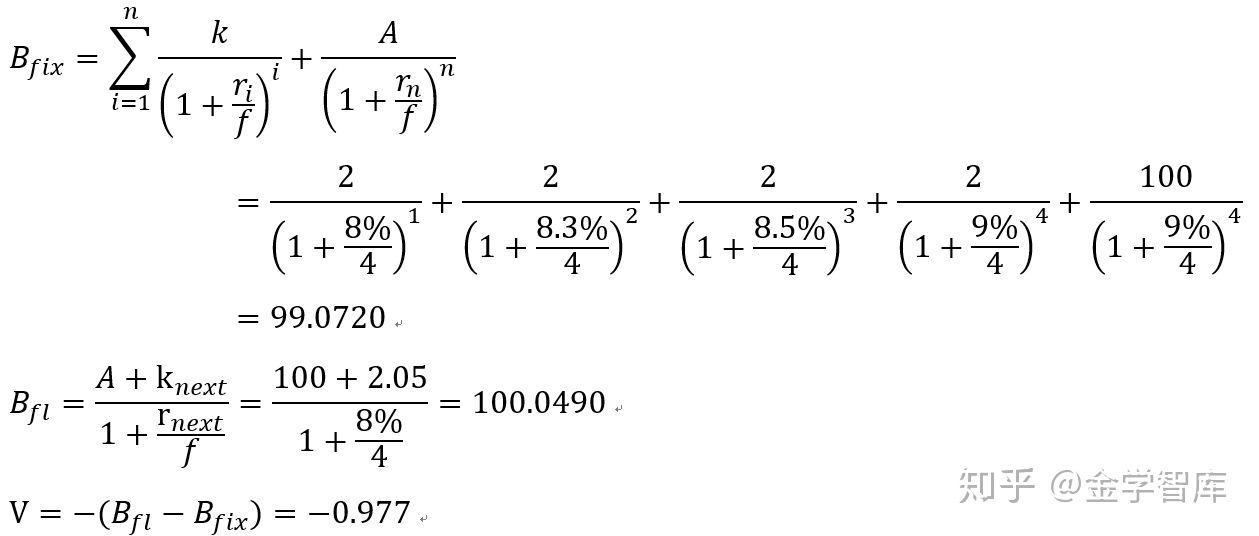

假设按照某利率互换条款,某一金融机构同意支付3个月期的SHIBOR,同时收取每年8%的利率(年化利率),名义本金为1亿美元,该互换还有1年时间到期。按照复利计算的3个月、6个月、9个月和12个月的相关贴现率分别是8%、8.3%、8.5%和9%。上一支付日所对应的SHIBOR为8.2%(年化利率)【定盘利率,定下一付息期的利率】。计算该利率互换对于该金融机构的价值。

注意该互换1年后到期,因此支付日从现在往后推分别是3个月后,6个月后,9个月和12个月后。该金融机构支浮收固,是互换空头,对于该金融机构来说互换价值为负。

import numpy as np

def int_swap_long(A,k,f,r,n,k_next):

'''计算利率互换价值的函数;

A:利率互换中的名义本金金额;

k:现金流交换日交换的固定利息额;

f:为年付息频率;

r:每期的贴现利率;

n:交换次数;'''

Bfix=sum(k/(1+r/f)**n)+A/(1+r[-1]/f)**n[-1]

Bfl=(A+k_next)/(1+r[0]/f)

return Bfl-Bfix

r1=np.array([0.08,0.083,0.085,0.09])

n1=np.array([1,2,3,4])

V=-int_swap_long(A=100,k=2,f=4,r=r1,n=n1,k_next=2.05) #调用利率互换损益计算函数

print('互换合约的价值为:',round(V,4))

#远期利率的计算

def Rf(R1,R2,T1,T2,n):

'''定义计算远期利率的函数;

R1:表示对应期限为T1的零息利率;

R2:表示对应期限为T2的零息利率;

T1:表示对应于零息利率R1的期限长度;

T2:表示对应于零息利率R2的期限长度;

n:表示年计息频率;'''

return (((1+R2/n)**(T2*n)/(1+R1/n)**(T1*n))-1)*n #一般复利

zero_rate=np.array([0.0314,0.0342,0.036,0.0384,0.0402,0.0426,0.0454,0.0495,0.0527,0.0568])

k=2 #付息频率

T_list=np.arange(1,len(zero_rate)+1)/k

R_result=Rf(R1=zero_rate[0:len(zero_rate)-1],R2=zero_rate[1:],T1=T_list[0:len(zero_rate)-1],T2=T_list[1:],n=k)

R_result=np.insert(R_result,0,zero_rate[0]) #第1期利率的即期利率=远期利率

print('远期利率为:',np.round(R_result,4))

#求解利率互换合约定价的固定利率

def fixingrate(A,t,k,R,f):

'''#求解利率互换合约定价的固定利率的函数

A:本金;

t:付息年化时间;

k:付息频率;

R:即期利率;

f:远期利率;'''

discount=np.zeros(len(t))

for i in range(len(t)): #求折现因子

discount[i]=1/((1+R[i]/(1/k))**(t[i]*k))

Bfl=A*1/k*sum(f*discount) #浮动端贴现价格

from scipy import optimize #求解固定利率y

def g(y):

e=Bfl-A*1/k*sum(y*discount) #固定端-浮动端=0

return e

result=optimize.fsolve(g,0.1) #猜测固定利率初始值0.1,不断迭代

return result

fixingrate1=fixingrate(A=100,t=T_list,k=2,R=zero_rate,f=R_result)

print('固定利率为:',np.round(fixingrate1,4))

Perfect Bloomberg Price Match of an Interest Rate Swap in Excel by using Dual Bootstrapping

https://blog.deriscope.com/index.php/en/excel-interest-rate-swap-price-dual-bootstrapping-curve

CASE STUDY_DUAL_SWAP_CURVE_VALUATION

CASE STUDY EQUITY_VANILLA_OPTION

期权计算

QuantLib计算欧式看涨期权

#coding=utf8

import QuantLib as ql

import matplotlib.pyplot as plt

# 1.设置期权的五要素以及分红率和期权类型

# 1.1五要素

maturity_date = ql.Date(11, 8, 2017)

spot_price = 9.37

strike_price = 10.00

volatility = 0.20 # the historical vols for a year

risk_free_rate = 0.001

# 1.2分红率

dividend_rate = 0.01

# 1.3期权类型

option_type = ql.Option.Call

# 1.4设置日期计算方式与使用地区

day_count = ql.Actual365Fixed()

calendar = ql.UnitedStates()

# 1.5计算期权价格的日期,也就是估值日,我们设为今天

calculation_date = ql.Date(11, 5, 2017)

ql.Settings.instance().evaluationDate = calculation_date

# 2.利用上的设置配置一个欧式期权

payoff = ql.PlainVanillaPayoff(option_type, strike_price)

exercise = ql.EuropeanExercise(maturity_date)

# 2.1根据payoff与exercise完成欧式期权的构建

european_option = ql.VanillaOption(payoff, exercise)

# 3.构造我们的BSM定价引擎

# 3.1 处理股票当前价格

spot_handle = ql.QuoteHandle(

ql.SimpleQuote(spot_price)

)

# 3.2 根据之前的无风险利率和日期计算方式,构建利率期限结构

flat_ts = ql.YieldTermStructureHandle(

ql.FlatForward(calculation_date, risk_free_rate, day_count)

)

# 3.3 设置分红率期限结构

dividend_yield = ql.YieldTermStructureHandle(

ql.FlatForward(calculation_date, dividend_rate, day_count)

)

# 3.4 设置波动率结构

flat_vol_ts = ql.BlackVolTermStructureHandle(

ql.BlackConstantVol(calculation_date, calendar, volatility, day_count)

)

# 3.5 构造BSM定价引擎

bsm_process = ql.BlackScholesMertonProcess(spot_handle,

dividend_yield,

flat_ts,

flat_vol_ts)

# 4使用BSM定价引擎计算

european_option.setPricingEngine(ql.AnalyticEuropeanEngine(bsm_process))

bs_price = european_option.NPV()

print "The theoretical price is ", bs_price

EQUITY_VANILLA_OPTION

利率互换期权计算

https://zhuanlan.zhihu.com/p/126306891

相关分析

CREDIT_SCORING:数据学习与分析

https://github.com/max-fitzpatrick/Credit-scoring-model/blob/master/CREDIT_SCORING_NOTEBOOK.ipynb

工具

DROP

主页:https://lakshmidrip.github.io/DROP/

工具箱:https://github.com/lakshmiDRIP/DROP/tree/master/Docs/Internal

干货(太棒了):https://github.com/lakshmiDRIP/DROP/blob/master/Docs/Internal/FixedIncomeAnalytics/FixedIncomeAnalytics_v3.11.pdf

浙公网安备 33010602011771号

浙公网安备 33010602011771号