Derivative Pricing_3_Dynamic (two stochastic bg)

1. Two-dimensional Wiener Process

dS1 = r·S1·dt + σ1·S1·dW1 ; and dS2 = r·S2·dt + σ2·S2·dW2

Solutions:

St = S0·exp[(r - σ2 /2 )·t + σ·Wt]

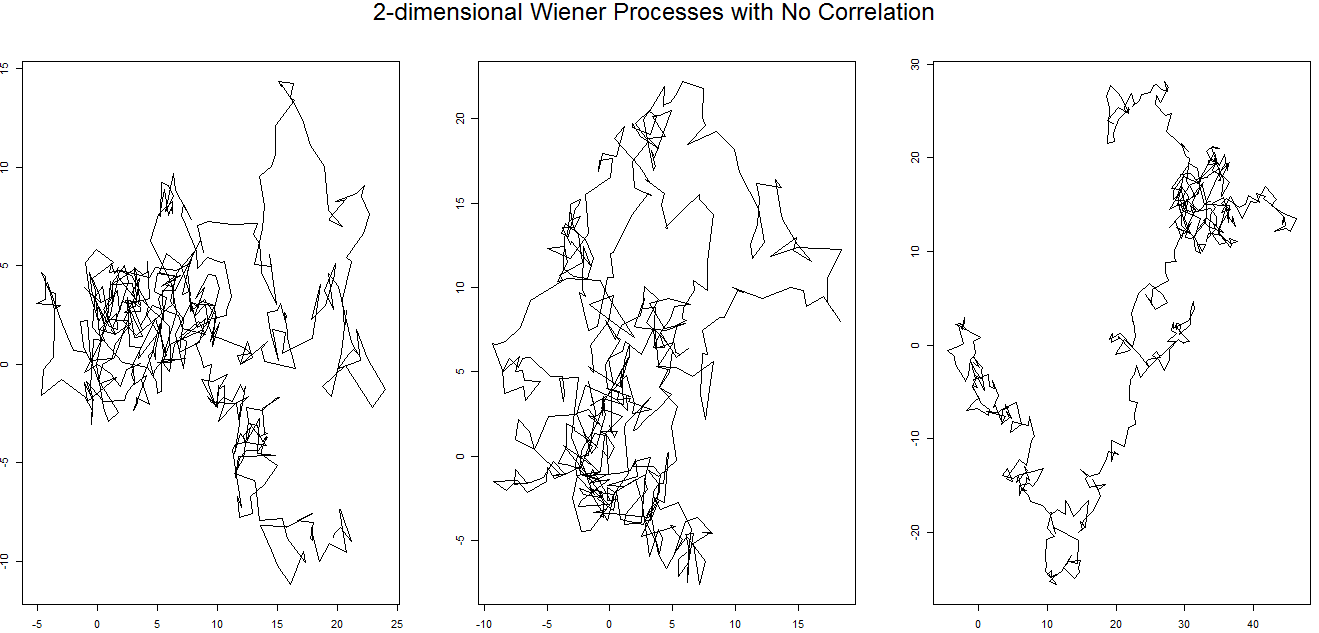

1.1 No Correlated

D2_Wiener <- function() {

dev.new(width = 10, height = 4)

par(mfrow = c(1, 3), oma = c(0, 0, 2, 0)) # bottom, l, top, r

for (i in 1:3) {

W1 <- cumsum(rnorm(500))

W2 <- cumsum(rnorm(500))

plot(W1, W2, type = 'l', ylab = '', xlab = '')

}

mtext('2-dimensional Wiener Processes with No Correlation',

outer = T, cex = 1.5, line = -1)

}

D2_Wiener()

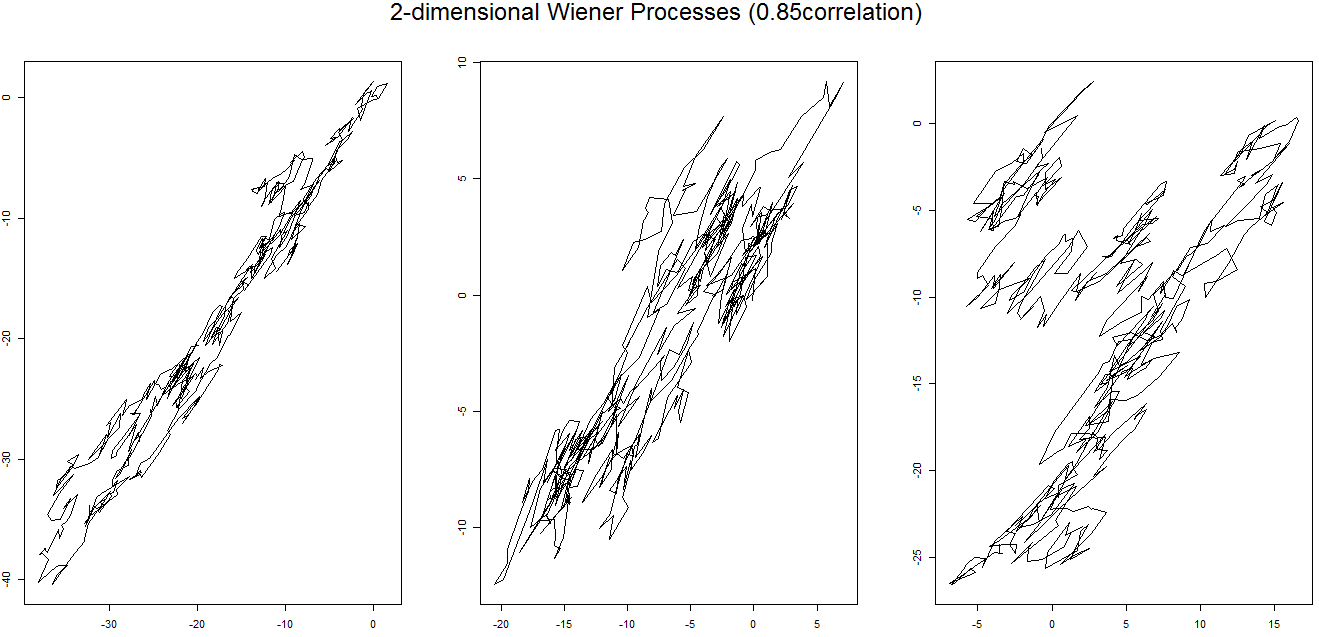

1.2 Correlated

D2_CorrWiener <- function(cor) {

dev.new(width = 10, height = 4)

par(mfrow = c(1, 3), oma = c(0, 0, 2, 0))

for (i in 1:3) {

W1 <- cumsum(rnorm(500))

W2 <- cumsum(rnorm(500))

W3 <- cor * W1 + sqrt(1 - cor^2) * W2

plot(W1, W3, type = 'l', ylab = '', xlab = '')

}

mtext(paste('2-dimensional Wiener Processes (', cor, 'correlation)',

sep = ''), outer = T, cex = 1.5, line = -1)

}

D2_CorrWiener(0.75)

2. Quanto Options (Quantity Adjusting Option) (using Margrabe formula) (需要修正)

Margrabe <- function(S1, S2, sigma1, sigma2, Time, rho, delta1 = 0,

delta2 = 0) {

sigma <-sqrt(sigma1 ^ 2 + sigma2 ^ 2 - 2 * sigma1 * sigma2 * rho)

d1 <- (log(S1 / S2) + (delta2 - delta1 + sigma ^ 2 / 2) * Time) /

(sigma * sqrt(Time))

d2 <- (log(S1 / S2) + (delta2 - delta1 + sigma ^ 2 / 2) * Time) /

(sigma * sqrt(Time))

M <- S1 * exp(-delta1 * Time) * pnorm(d1) - S2 * exp(-delta2 * Time) * pnorm(d2)

return(M)

}

浙公网安备 33010602011771号

浙公网安备 33010602011771号