Time Series_1_BRKA Case

Berkshire Hathaway (The most expensive stock ever in the world)

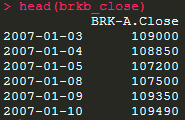

1.1 Download data

require(quantmod) data_env <- new.env() getSymbols(Symbols = 'BRK-A',env = data_env) brka_close <- do.call(merge, eapply(data_env, Cl))

1.2 Overview

1.2.1 Returns

Method 1

library(fImport)

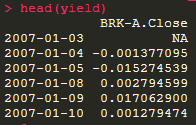

yield <- returns(brka_close)

head(yield)

Method 2

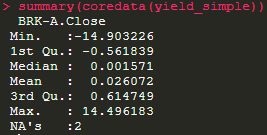

library(zoo)

# unit in percentage terms

yield_simple <- diff(brka_close) / lag(brka_close, k = -1) * 100

# coredate method: indicate we only care about price column, not the date

summary(coredata(yield_simple))

The biggest single-day loss is 14.90%, we can find out the date by:

yield_simple[which.min(yield_simple)]

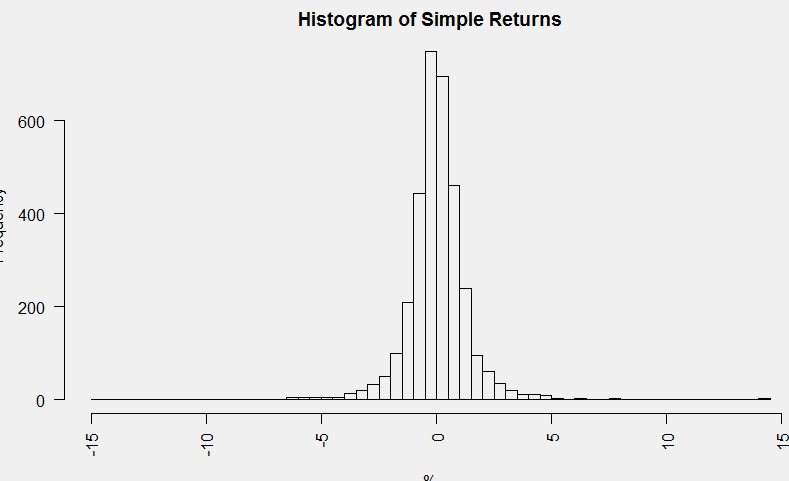

1.2.2 Distribution of returns

hist(yield_simple, breaks = 100,

main = 'Histogram of Simple Returns', xlab = '%')

1.2.3 Simple VaR calculation

To determine the 1-day 99% VaR:

quantile(yield_simple,na.rm = T, probs = 0.01)

Thus, the prob. that yield below 3.6894% on any given day is only 1%. If that day comes, 3.6894% is the minimum amount we will lose.

1.3 Modeling the price

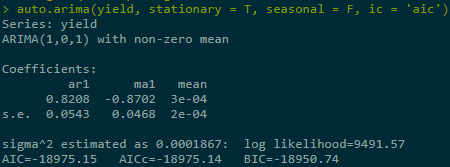

require(forecast) mod <- auto.arima(yield, stationary = T, seasonal = F, ic = 'aic')

AR(2) process didn't appear in the result below, which indicates that historic returns don't depend on earlier periods, i.e.,it depends on stochastic terms.

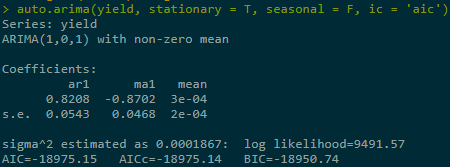

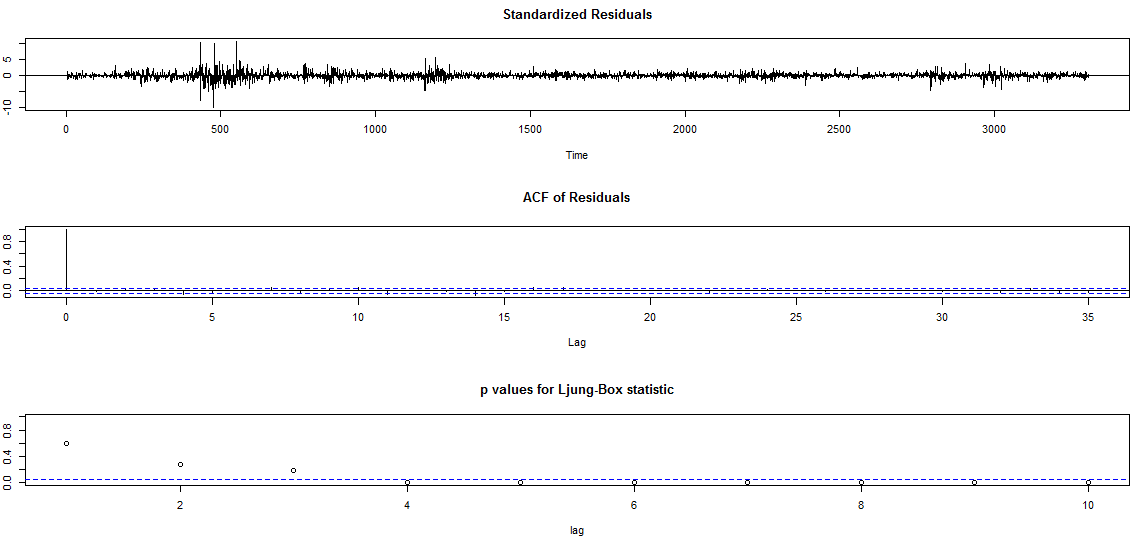

#compute confidence interval tsdiag(mod)

Time series diagnosis below, firstly there were volatility clusters in standard residuals throughout time, secondly no autocorrelations exisit within residuals in ACF test, thirdly, Ljung-Box show p-values small to reject null hypothesis.

浙公网安备 33010602011771号

浙公网安备 33010602011771号