金融数据分析| 因子选股策略

因子选股策略

因子选股策略

因子:选择股票的某种标准

增长率、 市值、 市盈率、 ROE(净资产收益率)

选股策略:

对于某个因子,选取表现最好(因子最大或最小)的N支股票持仓

每隔一段时间调仓一次

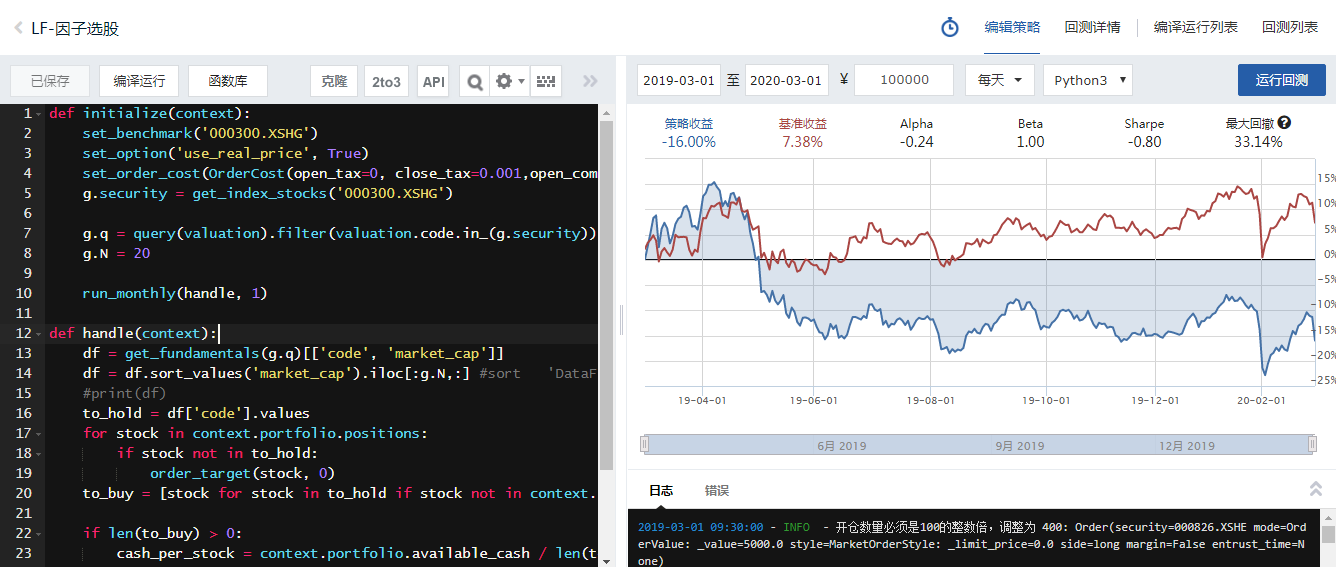

小市值策略:选取股票池中市值最小的N只股票持仓

def initialize(context): set_benchmark('000300.XSHG') set_option('use_real_price', True) set_order_cost(OrderCost(open_tax=0, close_tax=0.001,open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = get_index_stocks('000300.XSHG') g.q = query(valuation).filter(valuation.code.in_(g.security)) g.N = 20 run_monthly(handle, 1) def handle(context): df = get_fundamentals(g.q)[['code', 'market_cap']] df = df.sort_values('market_cap').iloc[:g.N,:] #sort 'DataFrame' object has no attribute 'sort' #print(df) to_hold = df['code'].values for stock in context.portfolio.positions: if stock not in to_hold: order_target(stock, 0) to_buy = [stock for stock in to_hold if stock not in context.portfolio.positions] if len(to_buy) > 0: cash_per_stock = context.portfolio.available_cash / len(to_buy) for stock in to_buy: order_value(stock, cash_per_stock)

点击运行回测查看详情:

多因子选股策略

def initialize(context): set_benchmark('000002.XSHG') set_option('use_real_price', True) set_order_cost(OrderCost(open_tax=0, close_tax=0.001,open_commission=0.0003, close_commission=0.0003, min_commission=5), type='stock') g.security = get_index_stocks('000002.XSHG') g.q = query(valuation, indicator).filter(valuation.code.in_(g.security)) g.N = 20 run_monthly(handle, 1) def handle(context): df = get_fundamentals(g.q)[['code', 'market_cap', 'roe']] #print(df) df['market_cap'] = (df['market_cap'] - df['market_cap'].min()) / (df['market_cap'].max() - df['market_cap'].min()) df['roe'] = (df['roe'] - df['roe'].min()) / (df['roe'].max() - df['roe'].min()) #print(df) df['score'] = df['roe'] - df['market_cap'] df = df.sort_values('score').iloc[-g.N:,:] #sort AttributeError: 'DataFrame' object has no attribute 'sort' to_hold = df['code'].values for stock in context.portfolio.positions: if stock not in to_hold: order_target(stock, 0) to_buy = [stock for stock in to_hold if stock not in context.portfolio.positions] if len(to_buy) > 0: cash_per_stock = context.portfolio.available_cash / len(to_buy) for stock in to_buy: order_value(stock, cash_per_stock)

浙公网安备 33010602011771号

浙公网安备 33010602011771号