海龟交易系统的实盘部署

近期(20240301)加密货币市场涨幅喜人,不断有新资金流入。笔者之前过对趋势交易有过一段时间研究,各种策略都略有了解,但在仓位管理和风险控制上都不太精通,比较幸运的是有一公开的趋势跟踪策略不仅可以跟踪趋势 还有基于波动率的风险控制方法,被称为海龟交易系统,在上个世纪曾经风靡一时。曾经用python写过一个海龟交易(原封不动的复刻的经典策略),但是没有对接实盘,今天就利用okx平台的接口接入实盘吧。

注意 这个海龟策略,有相当长的历史了 ,很多内容已经过时了 ,用于短期套利 完全没问题,毕竟是正宗的趋势交易法 盈亏比极大, 但是要长期投资的话 必然大亏! 投资上记住,收益的90%都来自正确的资产配置,这个道理已经被经济学家验证很多次了。

点击查看代码

import asyncio

import datetime

import json

import time

from okx import MarketData, Trade, Account

from okx.websocket.WsPublicAsync import WsPublicAsync

id = "PEPE-USDT"

bar = "1m"

class Kline:

def __init__(self, max_line=55, before='', after=''):

# API 初始化

apikey = "*******"

secretkey = "******"

passphrase = "****"

flag = "1" # 实盘: 0, 模拟盘: 1

self.accountAPI = Account.AccountAPI(apikey, secretkey, passphrase, False, flag)

self.tradeAPI = Trade.TradeAPI(apikey, secretkey, passphrase, False, flag)

self.n = None

self.max_units = 6

self.max_line = max_line

md = MarketData.MarketAPI(flag='1', debug=False)

ret = md.get_mark_price_candlesticks_chai(instId=id, limit=max_line, bar=bar, before=before, after=after)

self.ks = ret['data'][0:max_line]

print(f"初始化k线:{self.ks}")

# 由rest请求构建 由websocket维护

# atr(20) 10k高低线 20k高低线 55k高低线 平均持仓成本 前一订单的持仓成本 止损是atr的n倍数 浮盈前订单+0.5atr加仓

self.atr = None # atr

self.pyramid_input = 1 # 加仓的atr倍数

self.stop_input = 4 # 止损的atr倍数

self.l10 = self.h10 = self.l20 = self.h20 = self.l55 = self.h55 = 0

self.high = self.low = self.close = self.open = 0.0

self.position_avg_price = None # 市场的平均入场价

self.netprofit = 0.0 # 已完成交易的利润

self.position_size = 0.0 # 头寸的大小

self.position_price = 0.0 # 头寸的总成本 (持仓的市值)

# 查看账户余额

result2 = self.accountAPI.get_account_balance()

money=0.0

for i in result2["data"][0]["details"]:

if i["ccy"]=="USDT":

money=float(i["cashBal"])

print(money)

if money==0.0:

exit('money error')

self.capitalLeft = money # 总资金

self.initial_capital = money # 策略初始资金

self.riskPercent = 0.002 # 单笔交易承受的风险 越高持仓越多 加仓越少

self.exit_long = None

self.enter_long = None

self.risk = 0.01

self.win = False # 上次交易是否获利

self.buyPrice = 0.0 # 上次做多的价位

self.nextBuyPrice = 0.0 # 下一次做多的价位

self.stopPrice = 0.0 # 止损价

self.totalBuys = 0 # 金字塔加仓的总数

self.inBuy = False # 是否在一个做多的头寸

self.inBuy_p = False # 是否在一个做多的头寸

self.longLevel = None

self.mode = 'L1'

self.mode_p = 'L1'

self.fake = False

self.fake_p = False

self.fakeBuyPrice = 0.0 # 假交易的价位

self.shares = 0.0

self.sxf = 0.0 # 手续费

# o h l c

# ['1709080200000', '57031.1', '57107.4', '57031', '57102.7', '63367', '63.367', '3616608.9098', '0']

def buy(self, size):

msg = self.tradeAPI.place_order(instId=id,

tdMode="cash",

clOrdId="b15",

side="buy",

ordType="market",

sz=f"{size}")

return msg

def sell(self):

# 市价全平

result = self.accountAPI.get_max_order_size(

instId=id,

tdMode="isolated"

)

sell = float(result["data"][0]['maxSell'])

msg = self.tradeAPI.place_order(instId=id,

tdMode="cash",

clOrdId="b15",

side="sell",

ordType="market",

sz=f"{sell}")

print(msg)

self.netprofit = 0.0 # 已完成交易的利润

self.position_size = 0.0 # 头寸的大小

self.position_price = 0.0 # 头寸的总成本 (持仓的市值)

# 查看账户余额

result2 = self.accountAPI.get_account_balance()

money=self.initial_capital

for i in result2["data"][0]["details"]:

if i["ccy"]=="USDT":

money=float(i["cashBal"])

print(money)

self.capitalLeft = money # 总资金

self.initial_capital = money # 策略初始资金

def close(self):

pass

def run_s(self):

self.high, self.low, self.close, self.open = float(self.ks[0][2]), float(self.ks[0][3]), float(

self.ks[0][4]), float(self.ks[0][1])

self.inBuy_p = self.inBuy

self.mode_p = self.mode

self.fake_p = self.fake

# 判断是否进入做多头寸

if not self.inBuy and (self.high > self.h20 or self.high > self.h55):

self.inBuy = True

else:

# 判断是否需要退出做多头寸

if self.inBuy:

if self.mode == 'L1' and self.low < self.l10:

self.inBuy = False

elif self.mode == 'L2' and self.low < self.l20:

self.inBuy = False

elif self.low < self.stopPrice:

self.inBuy = False

# 如果没有头寸 且突破 上次盈利 就标记为虚假头寸

if not self.inBuy_p and self.high > self.h20 and self.win:

self.fake = True

self.fakeBuyPrice = self.close

# 当上个为假订单,在此时平仓,关闭假订单 并根据盈利情况赋值给win

if self.fake_p and self.inBuy_p and not self.inBuy:

self.fake = False

self.win = self.close >= self.fakeBuyPrice

# 突破h55时始终为真订单

self.fake = False if self.high > self.h55 else self.fake

# 当突破l1 2时记录多头水平

self.longLevel = 'L1' if not self.inBuy_p and self.high > self.h20 else None

if (not self.inBuy_p or (self.inBuy_p and self.fake)) and self.high > self.h55:

self.longLevel = 'L2'

if self.longLevel is not None:

self.mode = self.longLevel

if self.longLevel in ['L1', 'L2']:

self.buyPrice = self.close

self.totalBuys = 1

self.stopPrice = self.close - (self.stop_input * self.n)

self.nextBuyPrice = self.close + (self.pyramid_input * self.n)

# 当加仓时

if self.longLevel is None and self.inBuy_p and self.high > self.nextBuyPrice and self.totalBuys < self.max_units:

self.longLevel = 'P'

self.buyPrice = self.close

self.totalBuys += 1

self.stopPrice = self.close - (self.stop_input * self.n)

self.nextBuyPrice = self.close + (self.pyramid_input * self.n)

# Tracks stops and exits, marking them with SG or SR

if self.position_avg_price is not None:

if self.longLevel is None and self.inBuy_p and self.low < self.stopPrice and self.close >= self.position_avg_price:

self.longLevel = 'SG'

elif self.longLevel is None and self.inBuy_p and self.low < self.stopPrice and self.close < self.position_avg_price:

self.longLevel = 'SR'

elif self.longLevel is None and self.mode_p == 'L1' and self.inBuy_p and (

self.low < self.l10) and self.close >= self.position_avg_price:

self.longLevel = 'SG'

elif self.longLevel is None and self.mode_p == 'L2' and self.inBuy_p and (

self.low < self.l20) and self.close >= self.position_avg_price:

self.longLevel = 'SG'

elif self.longLevel is None and self.mode_p == 'L1' and self.inBuy_p and (

self.low < self.l10) and self.close < self.position_avg_price:

self.longLevel = 'SR'

elif self.longLevel is None and self.mode_p == 'L2' and self.inBuy_p and (

self.low < self.l20) and self.close < self.position_avg_price:

self.longLevel = 'SR'

# Tracks if the trade was a win or loss.

if self.longLevel == 'SG':

self.win = True

if self.longLevel == 'SR':

self.win = False

# Variables used to tell strategy when to enter/exit trade.

self.enter_long = (self.longLevel == 'L1' or self.longLevel == 'L2' or self.longLevel == 'P') and not self.fake

self.exit_long = (self.longLevel == 'SG' or self.longLevel == 'SR') and (not self.fake)

self.risk = (self.initial_capital + self.netprofit) * self.riskPercent

self.shares = float(self.risk / (self.stop_input * self.n))

if self.position_avg_price is not None:

self.capitalLeft = self.initial_capital + self.netprofit - (self.position_size * self.position_avg_price)

else:

self.capitalLeft = self.initial_capital + self.netprofit

if self.shares * self.close > self.capitalLeft:

self.shares = max(0.0, float(self.capitalLeft / self.close))

self.shares = max(0.0, self.shares)

# 做多时更新入场价

if self.enter_long:

self.position_size += self.shares # 头寸的大小

self.position_price += self.close * self.shares # 头寸成本增加

self.position_avg_price = self.position_price / self.position_size # 市场的平均入场价

print(

f"多{self.shares}张,price:{self.close},占:{self.shares * self.close / self.initial_capital * 100}%,{datetime.datetime.fromtimestamp(int(self.ks[0][0]) / 1000.0)}")

self.sxf += (self.shares * self.close) * 0.0008

if self.shares != 0.0:

self.buy(int(self.shares * self.close))

pass

if self.exit_long:

print(

f"平{self.position_size}张,price:{self.close},{datetime.datetime.fromtimestamp(int(self.ks[0][0]) / 1000.0)}")

self.netprofit += (self.close - self.position_avg_price) * self.position_size # 已完成交易的利润

self.position_size = 0.0 # 头寸的大小

self.position_avg_price = None # 市场的平均入场价

self.position_price = 0.0 # 头寸sum

print(f"交易盈利:{self.netprofit},手续费{self.sxf}")

self.sell()

# 指标数值更新

def reload(self, k):

if self.ks[0][0] == k[0][0]:

self.ks[0] = k[0]

else:

self.ks.insert(0, k[0])

del self.ks[self.max_line - 1]

# 更新atr值

self.atr = self.reload_atr(self.ks)

self.n = self.atr

# 更新各周期最大最小值

self.l10, self.h10 = kline.hl_find(self.ks, 10)

self.l20, self.h20 = kline.hl_find(self.ks, 20)

self.l55, self.h55 = kline.hl_find(self.ks, 55)

self.run_s()

@staticmethod

def hl_find(data, window):

d = data[0:window]

# o h l c

# ['1709080200000', '57031.1', '57107.4', '57031', '57102.7', '63367', '63.367', '3616608.9098', '0']

# 初始化最大值和最小值为第一个子列表的第2个元素 本次k线不算

min_value = float(data[1][3])

max_value = float(data[1][2])

# 遍历剩余子列表,更新最大值和最小值

for sublist in d[1:]:

if float(sublist[3]) < min_value:

min_value = float(sublist[3])

if float(sublist[2]) > max_value:

max_value = float(sublist[2])

return min_value, max_value

@staticmethod

def calculate_sma(data, window):

return sum(data[:window]) / window

@staticmethod

def reload_atr(ks):

# TR = max(high - low, abs(high - close[1]), abs(low - close[1]))

count = len(ks)

tr = [0.0] * count

# o h l c

# ['1709080200000', '57031.1', '57107.4', '57031', '57102.7', '63367', '63.367', '3616608.9098', '0']

for i in range(count - 1, -1, -1):

if i == count - 1:

tr[i] = float(ks[i][2]) - float(ks[i][3])

else:

tr[i] = max(float(ks[i][2]) - float(ks[i][3]), abs(float(ks[i][2]) - float(ks[i + 1][4])),

abs(float(ks[i][3]) - float(ks[i + 1][4])))

# ATR = SMA(TR, n)

# 计算SMA,时间段为3

atr = kline.calculate_sma(tr, 20)

return atr

def publicCallback(message):

# 解析字符串为Python对象

global kline

message = json.loads(message)

if 'data' in message:

k = message['data']

kline.reload(k)

pass

async def main():

# url = "wss://wspap.okex.com:8443/ws/v5/public?brokerId=9999"

url = "wss://wspap.okx.com:8443/ws/v5/business?brokerId=9999"

ws = WsPublicAsync(url=url)

await ws.start()

args = []

arg1 = {"channel": "candle1m", "instId": f"{id}"}

args.append(arg1)

await ws.subscribe(args, publicCallback)

await asyncio.sleep(9999999999999)

print("-----------------------------------------unsubscribe all--------------------------------------------")

await ws.unsubscribe(args, None)

if __name__ == '__main__':

kline = Kline(55)

asyncio.run(main())

"""

md2 = MarketData.MarketAPI(flag='1', debug=False)

before_s = 1708120700000

# 从2023开始, before="1708099200000", after="1708120800000"

kline = Kline(55, before="1707926400000", after="1708120800000")

for i in range(100000):

time.sleep(0.2)

ret3 = \

md2.get_mark_price_candlesticks_chai(instId=id, bar=bar, before=str(before_s),

after=str(before_s + 3600000))[

'data']

before_s += 3600000

kline.reload(ret3)

"""

点击查看代码

def buy(self, size):

msg = self.tradeAPI.place_order(instId=id,

tdMode="cash",

clOrdId="b15",

side="buy",

ordType="market",

sz=f"{size}")

money = self.capitalLeft

# 查看账户余额

result2 = self.accountAPI.get_account_balance()

for i in result2["data"][0]["details"]:

if i["ccy"]=="USDT":

money=float(i["cashBal"])

print(money)

self.capitalLeft = money # 总资金

return msg

买完之后更新下持仓

还有 如果程序发错了错误的买卖指令或者明显不合理的指令 要有函数能拦截 不让指令发出 这个功能我是这样实现的

点击查看代码

# size 是真实的买单金额

def check(self,size,warning_value=0.5):

if size>self.capitalLeft*warning_value:

self.sell()

exit("order size>warning_value !")

在买入指令下达前直接检测金额是否超过警戒值 如果超过 全部头寸卖出后退出程序

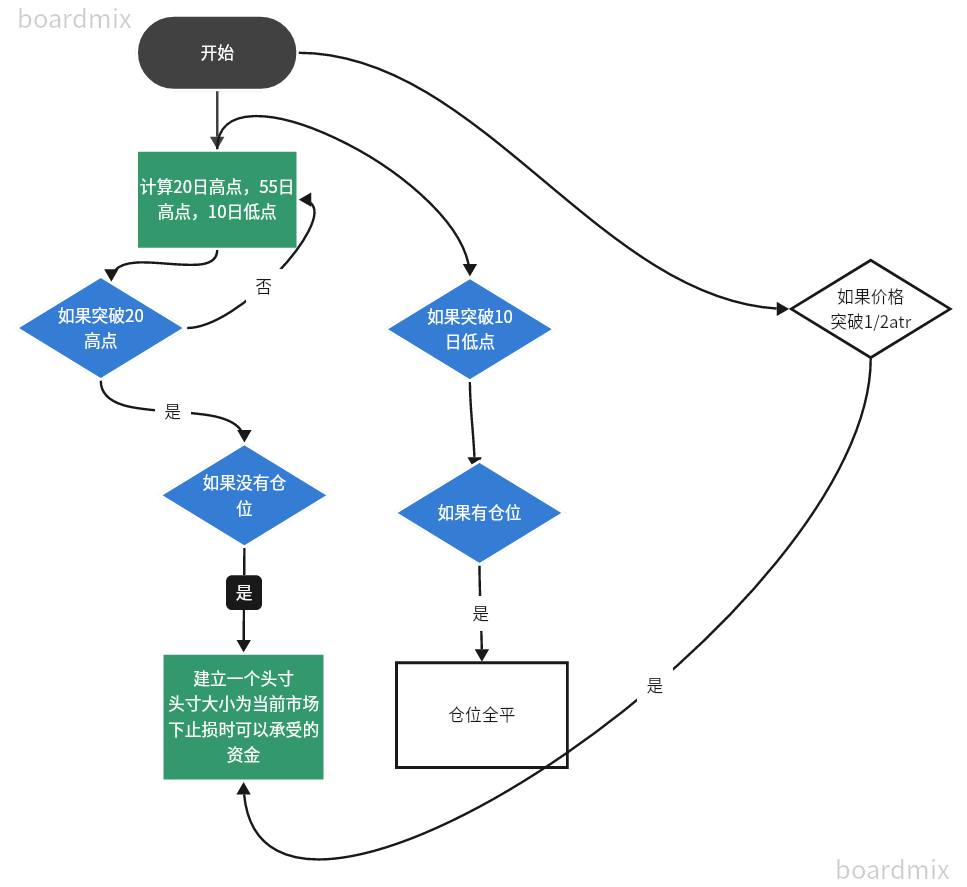

其实对接还是比较简单的 几乎没有难对 就是对着api文档编程 难点全在买卖系统的建模 传统海龟交易模型 有很大的漏洞 当交易成本(手续费,流动性)太大,会在大量的止损单中损失大部分本金,这些买卖模型的建模需要非常复杂的逻辑实现 现代的交易系统大多使用强化学习,统计分析等手段实现,这里不做过多解释,最后给出程序的流程图希望对大家的投机或者赌博有所帮助。

这个流图没画完 原版还有虚假头寸和自保险下单的逻辑还有仓位控制 逻辑太复杂 懒得画了,感兴趣参考最开始我写的代码吧

浙公网安备 33010602011771号

浙公网安备 33010602011771号