增长模型:R 语言复现

-

课程开始时,鉴于电子商务专业的同学编程能力很强,教师承诺过会给一个关于增长模型的代码复现例子。

-

Here we go!

MRW 1992

-

数据和模型均来自论文, “A Contribution to the Empirics of Economic Growth”

- Greg Mankiw, David Romer and David Weil (QJE, 1992)

-

索洛模型:储蓄率和人口增长率决定了稳态时的人均收入

-

问:现实中,储蓄率和人口增长率低的国家,人均 GDP 会更高么?

-

MRW: 对,但不完全对

-

储蓄率和人口增长率只能解释不同国家质检约 50% 的收入差距

-

如果加入人力资本,可以解释 80% 的收入差距

模型设定

\[Y(t) = K(t)^\alpha [A(t) L(t)]^{1-\alpha} \; \text{where} \; 0 < \alpha < 1

\]

\[L(t) = L(0) e^{nt}

\]

\[A(t) = A(0) e^{gt}

\]

\[\dot{k}(t) = sk(t)^\alpha - (n+g+\delta)k(t)

\]

\[k^* = [\frac{s}{n+g+\delta}]^{\frac{1}{1-a}}

\]

- 其中 \(\alpha = 2/3\)

Exploratory data analysis

library(AER)

library(dplyr)

library(skimr)

library(moderndive)

data("GrowthDJ")

skim(GrowthDJ)

── Data Summary ────────────────────────

Values

Name GrowthDJ

Number of rows 121

Number of columns 10

_______________________

Column type frequency:

factor 3

numeric 7

________________________

Group variables None

── Variable type: factor ──────────────────────────────────────────────────────────────────────────

skim_variable n_missing complete_rate ordered n_unique top_counts

1 oil 0 1 FALSE 2 no: 98, yes: 23

2 inter 0 1 FALSE 2 yes: 75, no: 46

3 oecd 0 1 FALSE 2 no: 99, yes: 22

── Variable type: numeric ─────────────────────────────────────────────────────────────────────────

skim_variable n_missing complete_rate mean sd p0 p25 p50 p75 p100 hist

1 gdp60 5 0.959 3682. 7493. 383 973. 1962 4274. 77881 ▇▁▁▁▁

2 gdp85 13 0.893 5683. 5689. 412 1209. 3484. 7719. 25635 ▇▂▂▁▁

3 gdpgrowth 4 0.967 4.09 1.89 -0.9 2.8 3.9 5.3 9.2 ▁▅▇▃▁

4 popgrowth 14 0.884 2.28 0.999 0.3 1.7 2.4 2.9 6.8 ▃▇▃▁▁

5 invest 0 1 18.2 7.85 4.1 12 17.7 24.1 36.9 ▅▇▇▅▂

6 school 3 0.975 5.53 3.53 0.4 2.4 4.95 8.17 12.1 ▇▆▅▅▅

7 literacy60 18 0.851 48.2 35.4 1 15 39 83.5 100 ▇▃▂▃▆

Estimation

-

参数校准:\(g + \delta = 0.5\)

-

下面以 MRW 中数据中的样本 1 为例进行估计

nonoil <- subset(GrowthDJ, oil == "no")

inter <- subset(GrowthDJ, inter == "yes")

oecd <- subset(GrowthDJ, oecd == "yes")

mrw1 <- lm(log(gdp85) ~ log(invest/100) + log((popgrowth/100) + 0.05), data = nonoil)

mrw2 <- lm(log(gdp85) ~ log(invest/100) + log((popgrowth/100) + 0.05), data = inter)

mrw3 <- lm(log(gdp85) ~ log(invest/100) + log((popgrowth/100) + 0.05), data = oecd)

summary(mrw1)

Residuals:

Min 1Q Median 3Q Max

-1.79144 -0.39367 0.04124 0.43368 1.58046

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 5.4299 1.5839 3.428 0.000900 ***

log(invest/100) 1.4240 0.1431 9.951 < 2e-16 ***

log((popgrowth/100) + 0.05) -1.9898 0.5634 -3.532 0.000639 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.6891 on 95 degrees of freedom

Multiple R-squared: 0.6009, Adjusted R-squared: 0.5925

F-statistic: 71.51 on 2 and 95 DF, p-value: < 2.2e-16

Restricted regression

- Restriction: \(\ln (s)\) 与 \(\ln(g+n+\delta)\) 的和为0

mrw4 <- lm(log(gdp85) ~ I(log(invest/100) - log((popgrowth/100) + 0.05)), data = nonoil)

mrw5 <- lm(log(gdp85) ~ I(log(invest/100) - log((popgrowth/100) + 0.05)), data = inter)

mrw6 <- lm(log(gdp85) ~ I(log(invest/100) - log((popgrowth/100) + 0.05)), data = oecd)

summary(mrw4)

Residuals:

Min 1Q Median 3Q Max

-1.87388 -0.43133 0.03757 0.51698 1.49645

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.8724 0.1206 56.99 <2e-16 ***

I(log(invest/100) - log((popgrowth/100) + 0.05)) 1.4880 0.1247 11.93 <2e-16 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.6885 on 96 degrees of freedom

Multiple R-squared: 0.5974, Adjusted R-squared: 0.5932

F-statistic: 142.4 on 1 and 96 DF, p-value: < 2.2e-16

-

运算结果表明,\((N+g+\delta)\) 的系数显著为负,而储蓄 \(s\) 的系数显著为正

- 这和索洛模型的预测一致

-

但是,restricted regression 中计算得到的 \(\alpha= 0.6\), 和实际不符

考虑加入人力资本的有效劳动人口

- 衡量人力资本:使用不同时间段的“劳动人口中完成中学教育的比例”作为代理变量

- 从 \(R^2\) 可以看出,加入人力资本后的索洛模型,可以解释不同国家之间 80% 的收入差距

- 同时,\(\alpha\) 的取值也接近 1/3. 这和实际数据一致

- 因此,加入人力资本后的索洛模型,能更好地解释不通国家之间的收入差距

mrw7 <- lm(log(gdp85) ~ log(invest/100) + log((popgrowth/100) + 0.05) + log(school/100), data = nonoil)

mrw8 <- lm(log(gdp85) ~ log(invest/100) + log((popgrowth/100) + 0.05) + log(school/100), data = inter)

mrw9 <- lm(log(gdp85) ~ log(invest/100) + log((popgrowth/100) + 0.05) + log(school/100), data = oecd)

mrw10 <- lm(log(gdp85) ~ I(log(invest/100) - log((popgrowth/100) + 0.05)) + I(log(school/100) - log((popgrowth/100) + 0.05)), data = nonoil)

mrw11 <- lm(log(gdp85) ~ I(log(invest/100) - log((popgrowth/100) + 0.05)) + I(log(school/100) - log((popgrowth/100) + 0.05)), data = inter)

mrw12 <- lm(log(gdp85) ~ I(log(invest/100) - log((popgrowth/100) + 0.05)) + I(log(school/100) - log((popgrowth/100) + 0.05)), data = oecd)

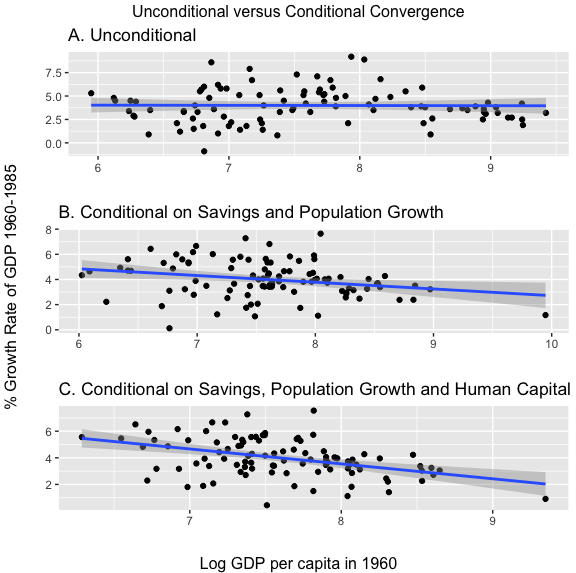

收敛和条件收敛

- 索洛模型的另一个主要预测,是有类似条件的国家,稳态时的人均 GDP 会收敛 (conditional convergence)

- 此外,它还定量说明了收敛的速度

- 我们用 1960--1985 年之间不同国家的相关数据,对这个预测进行检验

converge1 <- lm(I(log(gdp85)-log(gdp60)) ~ log(gdp60), data = nonoil)

summary(converge1)

Residuals:

Min 1Q Median 3Q Max

-1.09784 -0.27467 -0.02826 0.25975 1.17747

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.26658 0.37960 -0.702 0.4842

log(gdp60) 0.09431 0.04962 1.901 0.0603 .

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.4405 on 96 degrees of freedom

Multiple R-squared: 0.03627, Adjusted R-squared: 0.02623

F-statistic: 3.613 on 1 and 96 DF, p-value: 0.06033

converge4 <- lm(I(log(gdp85)-log(gdp60)) ~ log(gdp60) + log(invest/100) + log(popgrowth/100 + 0.05), data = nonoil)

summary(converge4)

Residuals:

Min 1Q Median 3Q Max

-1.07648 -0.15215 0.01185 0.19595 0.96056

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.91938 0.83367 2.302 0.02352 *

log(gdp60) -0.14090 0.05202 -2.709 0.00803 **

log(invest/100) 0.64724 0.08670 7.465 4.16e-11 ***

log(popgrowth/100 + 0.05) -0.30235 0.30438 -0.993 0.32311

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.3507 on 94 degrees of freedom

Multiple R-squared: 0.4019, Adjusted R-squared: 0.3828

F-statistic: 21.05 on 3 and 94 DF, p-value: 1.622e-10

converge7 <- lm(I(log(gdp85)-log(gdp60)) ~ log(gdp60) + log(invest/100) + log(popgrowth/100 + 0.05) + log(school/100), data = nonoil)

summary(converge7)

Residuals:

Min 1Q Median 3Q Max

-0.91041 -0.17599 0.01789 0.18439 0.93846

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 3.02152 0.82748 3.651 0.000431 ***

log(gdp60) -0.28837 0.06158 -4.683 9.62e-06 ***

log(invest/100) 0.52374 0.08687 6.029 3.30e-08 ***

log(popgrowth/100 + 0.05) -0.50566 0.28861 -1.752 0.083061 .

log(school/100) 0.23112 0.05946 3.887 0.000190 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.327 on 93 degrees of freedom

Multiple R-squared: 0.4855, Adjusted R-squared: 0.4633

F-statistic: 21.94 on 4 and 93 DF, p-value: 8.987e-13

回归结果:

-

不存在绝对收敛

-

控制储蓄率和人口增长后,存在条件收敛的趋势

-

进一步控制人力资本变量后,条件收敛的趋势非常明显

收敛图示

library(ggplot2)

library(gridExtra)

controlx1 <- lm(log(gdp60) ~ log(invest/100) + log(popgrowth/100 + 0.05), data = nonoil)

controlx1res <- residuals(controlx1)

controly1 <- lm(gdpgrowth ~ log(invest/100) + log(popgrowth/100 + 0.05), data = nonoil)

controly1res <- residuals(controly1)

controlx2 <- lm(log(gdp60) ~ log(invest/100) + log(popgrowth/100 + 0.05) + log(school/100), data = nonoil)

controlx2res <- residuals(controlx2)

controly2 <- lm(gdpgrowth ~ log(invest/100) + log(popgrowth/100 + 0.05) + log(school/100), data = nonoil)

controly2res <- residuals(controly2)

p1 <- ggplot(data = nonoil, mapping = aes(x=log(gdp60), y=gdpgrowth)) + geom_point() + geom_smooth(method = "lm") + labs(title = "A. Unconditional", x = "", y="")

p2 <- ggplot(data = nonoil, mapping = aes(x=(mean(log(gdp60))+controlx1res), y=(mean(gdpgrowth)+controly1res))) + geom_point() + geom_smooth(method = "lm") + labs(title = "B. Conditional on Savings and Population Growth", x = "", y="")

p3 <- ggplot(data = nonoil, mapping = aes(x=(mean(log(gdp60))+controlx2res), y=(mean(gdpgrowth)+controly2res))) + geom_point() + geom_smooth(method = "lm") + labs(title = "C. Conditional on Savings, Population Growth and Human Capital", x = "", y="")

grid.arrange(p1, p2, p3, ncol=1, top = "Unconditional versus Conditional Convergence", left = "% Growth Rate of GDP 1960-1985", bottom = "Log GDP per capita in 1960")

posted on 2021-06-18 20:19 Albert_Lei 阅读(419) 评论(0) 收藏 举报

浙公网安备 33010602011771号

浙公网安备 33010602011771号